The Weekly Update

Week of July 7th, 2025

By Christopher T. Much, CFP®, AIF®

Trade developments and continued momentum pushed all three major averages to modest gains again for a shortened holiday trading week.

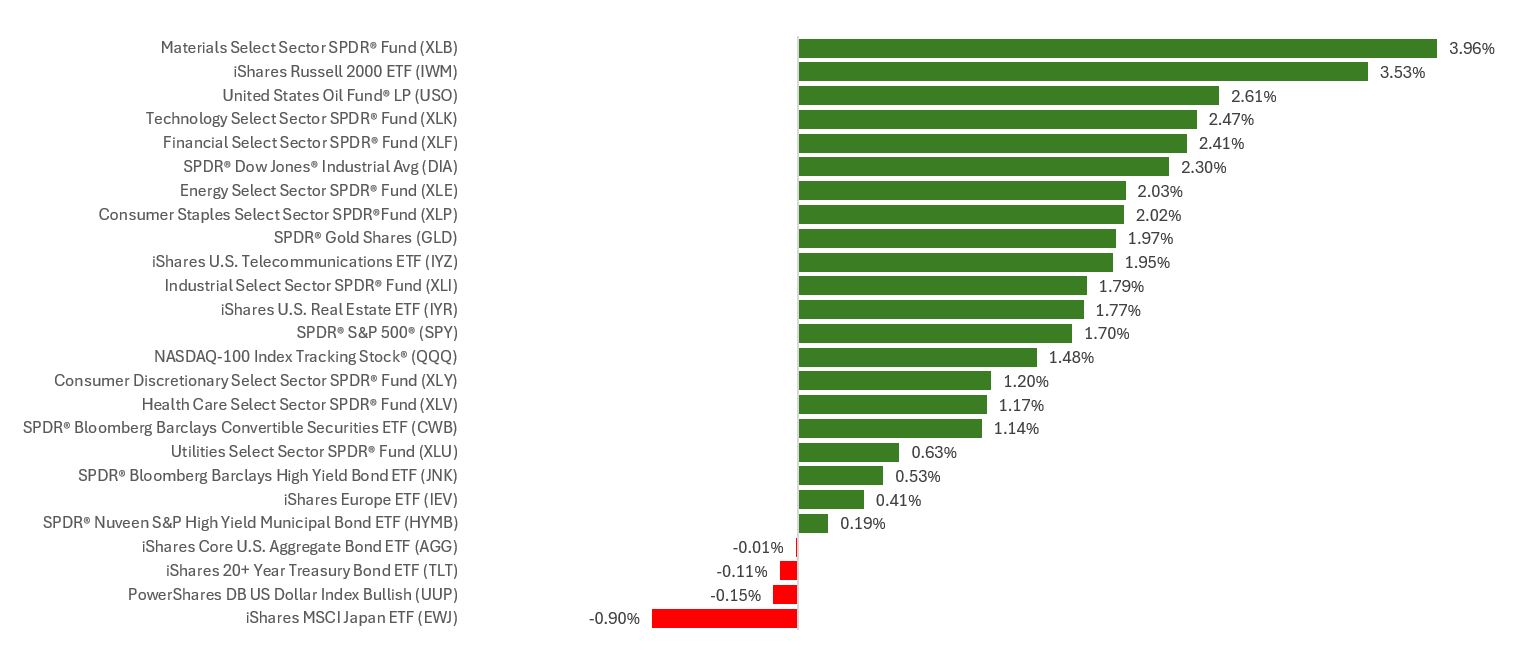

The Standard & Poor’s 500 Index rose 1.72 percent, while the Nasdaq Composite Index added 1.62 percent. The Dow Jones Industrial Average advanced 2.30 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, increased 0.19 percent for the week through Thursday.

Stocks Gain on Trade Developments

Stocks continued their momentum from the prior week’s records following Canada’s rescinding of its digital services tax, rising on optimism as investors waited for more news on trade.

The S&P 500 and Nasdaq took a breather on July’s first trading day, while the Dow Industrials posted a modest gain. Then, stocks rallied after the news of the trade deal with Vietnam, moving past the latest ADP employment report, which showed reduced jobs last month for the first time in two years.

In a quick retort to the ADP report, a better-than-expected June jobs report from the Bureau of Labor Statistics gave stocks another boost, reassuring investors that the U.S. economy was weathering trade and geopolitical shocks. The S&P and Dow hit record highs as the short trading week ended.

Jobs Report Mostly Positive

The labor report for June had a few points for investors to cheer. First, employers added 147,000 jobs in June—that was 37,000 higher than economists were expecting. Unemployment ticked down to 4.1 percent from 4.2 percent. Previously reported job gains from April and May were revised upward by 16,000.

Still, companies are in a “no hire, no fire” mode as they wait to see how trade policy impacts the economy. Caveats to the headline numbers: most gains were seen in government and healthcare. Several other sectors, including manufacturing and professional services, were flat or diminished.

The takeaway: good news overall, but uncertainty still lingers beneath the employment surface.

This Week: Key Economic Data

Tuesday: NFIB Small Business Optimism Index. Consumer Credit.

Wednesday: Wholesale Inventories. 10-Year Treasury Note Auction. June Fed Meeting Minutes.

Thursday: Weekly Jobless Claims. St. Louis Fed President Alberto Musalem and San Francisco Fed President Mary Daly speak.

Friday: Federal Budget.

Source: Investor’s Business Daily – Econoday economic calendar; July 3, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

No major companies reporting this week.

Source: Zacks, July 3, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.