The Weekly Update

Week of June 30th, 2025

By Christopher T. Much, CFP®, AIF®

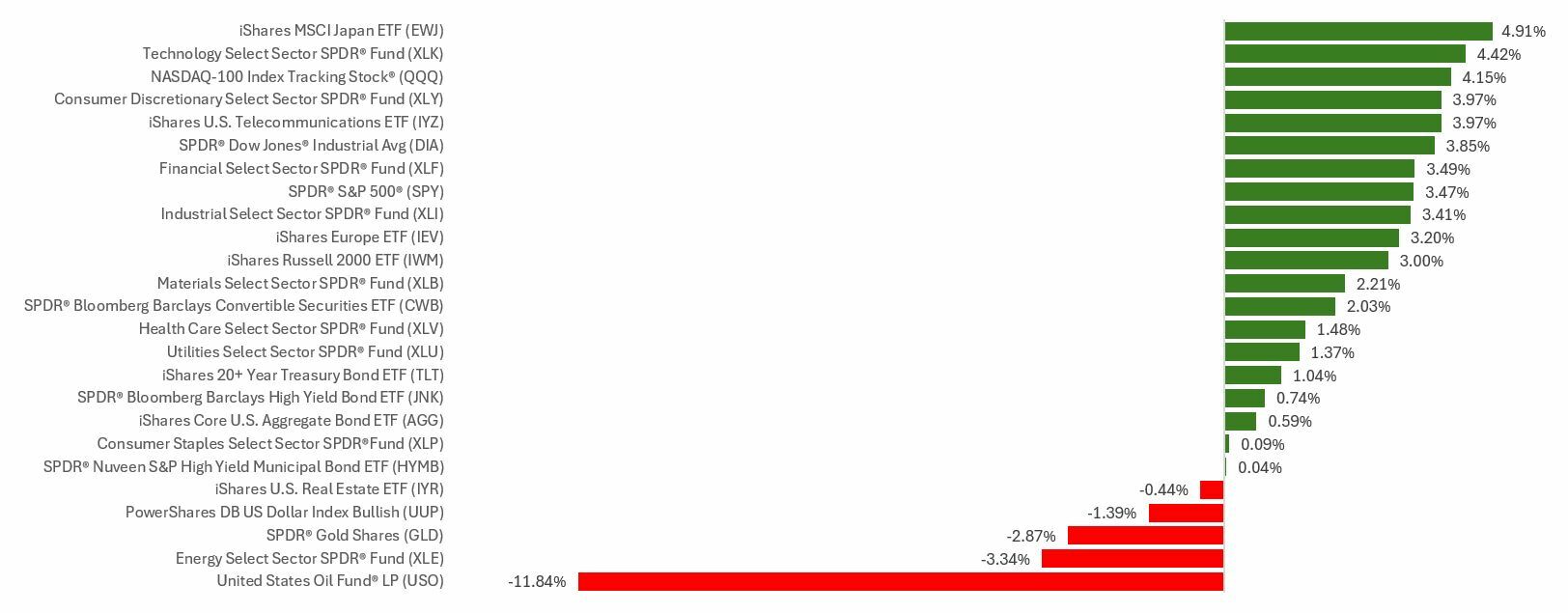

Stocks staged a broad-based rally last week on investors’ hopes for a lasting Middle East ceasefire, hitting fresh record highs along the way.

The Standard & Poor’s 500 Index rose 3.44 percent, while the Nasdaq Composite Index added 4.25 percent. The Dow Jones Industrial Average advanced 3.82 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, increased 3.04 percent.

Stocks Push Higher

Last week opened with a rally powered by news of a tamer-than-expected escalation of tensions in the Middle East. Stocks continued their rise after this week’s ceasefire agreement, although Wall Street appeared concerned about whether the truce would remain in place.

Sentiment brightened after the White House played down the approaching July 8th tariff deadlines. Solid corporate earnings, a still-strong labor market, and a recovery in artificial intelligence-related stocks provided some underlying strength to the rally.

As the week wrapped up, the S&P 500 hit its first new high since February—it marked the fastest-ever recovery from a 15-percent decline for the broad-market index. The tech-heavy Nasdaq Composite also closed at an all-time high. Following the decision, Fed Chair Powell said policymakers are “well positioned to wait” before moving on short-term rates. Powell indicated that trade policy has clouded the inflation outlook, making policymakers concerned about consumer prices.

Economic Data Helped, Too

While trade and Middle East updates powered most of the markets’ rise last week, a few economic bits of news also contributed to the week-long rally. For example, consumer sentiment climbed 16 percent in May—its first increase in six months.

“The improvement was broad-based across numerous facets of the economy, with expectations for personal finances and business conditions climbing about 20% or more,” the University of Michigan said in a statement.

This Week: Key Economic Data

Monday: Fed Officials Raphael Bostic and Austan Goolsbee speak.

Tuesday: Fed Chair Jerome Powell speaks. ISM Manufacturing Index. Construction Spending. Job Openings.

Wednesday: Motor Vehicle Sales. ADP Employment Report.

Thursday: U.S. Employment Report. International Trade in Goods & Services. Fed Official Raphael Bostic speaks. Factory Orders. ISM Services Index. 10-Year Treasury Note Announcement. Federal Balance Sheet.

Friday: MARKET HOLIDAY

Source: Investor’s Business Daily – Econoday economic calendar; June 27, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Constellation Brands Inc. (STZ)

Source: Zacks, June 27, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.