The Weekly Update

Week of October 9, 2017

By Christopher T. Much, CFP®, AIF®

This Monday, October 9, marks the 10-year anniversary of the S&P 500’s highest point before the Great Recession. While the ensuing decade has provided quite a rocky road for the markets at times, the recovery is undeniable. The S&P 500 is now double its peak 10 years ago.

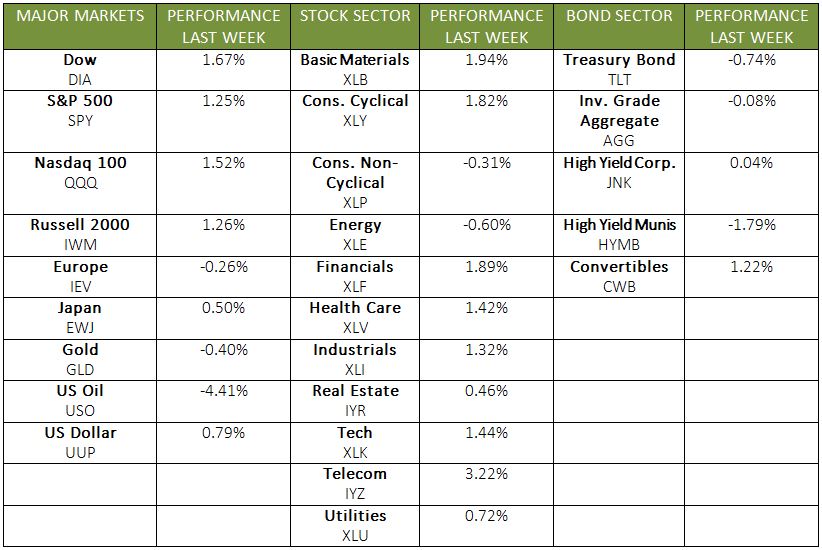

In fact, last week, markets posted one record high after another—and the S&P 500 had its longest streak of record closes since 1997. At the markets’ close, the S&P 500 added 1.19%, the Dow gained 1.65%, and the NASDAQ grew by 1.45%. International stocks in the MSCI EAFE lost 0.07%.

These domestic gains came despite stocks stumbling slightly on Friday in reaction to disappointing jobs numbers. After 7 years of monthly growth, the September jobs report indicated the first labor market contraction since 2010, with 33,000 jobs lost. The decrease was largely due to the aftermath of Hurricanes Harvey and Irma. Despite this unexpected contraction, however, the unemployment rate fell to its lowest level in 16 years, and average hourly earnings increased by 2.9%.

We also began the first trading week of the 4th quarter last Monday, so we will review Q3’s performance and what lies ahead for Q4.

How did the markets perform in Q3?

If we had to pick one word to describe performance in Q3, it would be: positive.

1. Sustained Market Growth

Throughout the quarter, all four indexes we track in this weekly update had solid showings and hit many record highs. The S&P 500 was up 3.96%, the Dow rose 4.94%, the NASDAQ jumped 5.79%, and the MSCI-EAFE gained 4.81%. Both the Dow and S&P 500 marked their 8th straight quarter of gains, and the NASDAQ was not far behind with its 5th positive quarter in a row. The S&P 500 even had its least volatile September in over 47 years.

2. Continued Global Gains

Globally, European and emerging markets posted their 3rd straight quarters of impressive gains. In September, Chinese manufacturing experienced its fastest growth since 2012.

What drove the markets in Q3?

Rather than last quarter’s growth rallying around a few sectors, markets advanced broadly in Q3, with 10 of the 11 S&P 500 sectors gaining. This positive performance reflects solid corporate earnings, stronger oil prices, and impressive core capital goods orders—though inflation remained below the Fed’s target of 2%.

What is on the horizon for Q4?

By most accounts, betting against a strong 4th quarter seems like a bad idea: The S&P 500 has grown during Q4 in 7 out of the past 8 years. Americans remain generally bullish on the economy and continue to increase their spending as their incomes grow and inflation remains low.

In addition, manufacturing, services, and housing all seem to be supporting economic expansion. This growth is not limited to the United States; globally, 94% of countries are experiencing year-over-year economic growth.

Of course, the coming weeks will give us an even clearer understanding of Q3 performance—and Q4 expectations. If you have questions about how the markets are affecting your portfolio and future, please let us know. We are here to provide the guidance you need and help clarify your investment process.

ECONOMIC CALENDAR

Monday: Banks Closed for Columbus Day Holiday

Wednesday: JOLTS

Thursday: Jobless Claims

Friday: Consumer Price Index, Retail Sales, Consumer Sentiment