The Weekly Update

Week of September 12, 2017

By Christopher T. Much, CFP®, AIF®

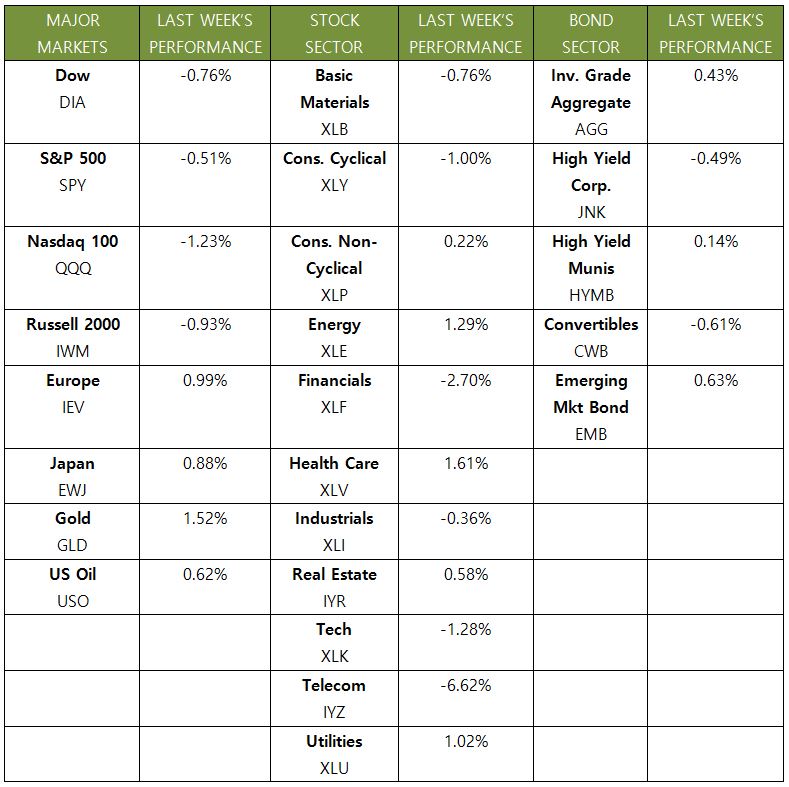

Last week, the markets closed for Labor Day, and in the subsequent four trading days, all three domestic indexes gave back some recent gains. The S&P 500 declined 0.61%, the Dow lost 0.86%, and the NASDAQ slid 1.17%. International stocks in the MSCI EAFE faired better, ending Friday up 0.78% for the week.

On Wednesday, September 6, we received solid data from the services sector, with the ISM Non-Manufacturing Index showing growth in 15 of the 18 industries it tracks. The trade deficit also stayed relatively static for July, avoiding the widening trade gap forecasters predicted. Both reports may indicate that the economy continues to be on stronger ground than many people believe.

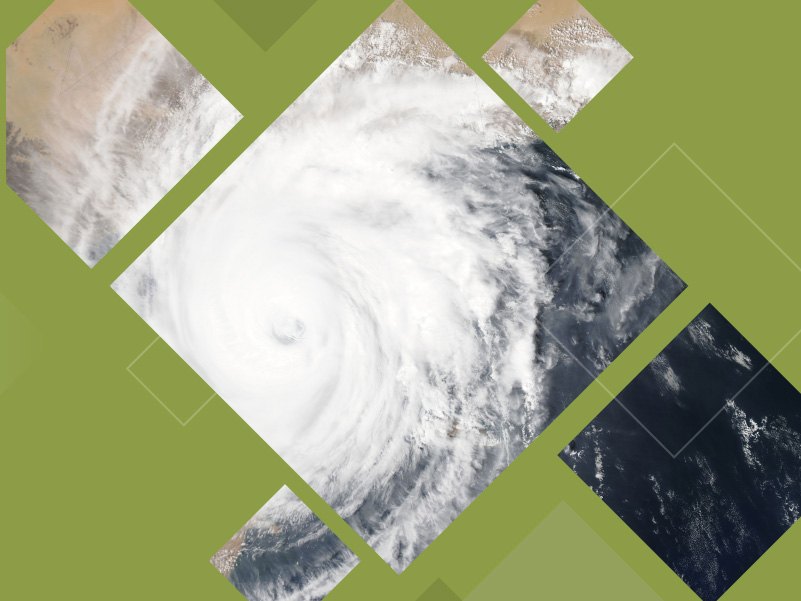

But last week’s new economic reports were not what drove many headlines or captured people’s attention. Between Hurricane Harvey’s devastation in Texas and Louisiana, Irma bearing down on Florida and the Southeast, and new hurricanes Jose and Katia forming offshore, weather was on everyone’s minds. Understanding the economic effects these weather events can create is important for proactively planning ahead.

How Hurricanes Affected the Markets

- Insurance Companies Stumbled—Then Recovered

Large natural disasters can be incredibly costly for insurance companies. Last week, despite Friday’s price recovery, many insurance stocks and ETFs lost considerable ground, as investors contemplated whether insurers would be able to withstand the costs of Hurricanes Harvey and Irma. - Materials Suppliers Jumped

While hurricanes are challenging for insurers, they can drive growth for companies who will help provide materials when rebuilding begins. With Hurricane Irma predicted to “devastate” areas of the U.S., a number of building suppliers added over 1% to their stock prices on Friday. - Restaurant Stocks Struggled

Several major restaurant brands saw their stock prices drop last week. Restaurants with a large number of locations in hurricane-damaged areas could experience lower sales throughout the rest of 2017.

What to Expect for Long-Range Impacts

With Hurricane Irma battering the southern states and Harvey’s waters still receding, we are far from knowing the final tally of either hurricane’s destruction. However, some estimates indicate that recovery could cost as much as $100 billion or more—for each storm.

Due to these massive recovery efforts, natural disasters like this can end up having a net-positive effect on the economy. Ultimately, industries such as construction, transportation, and logistics often benefit from rebuilding. Meanwhile, industries such as insurance and hospitality may suffer due to the losses they experience.

While the costs from damages will be immense, the true economic impact will be important to track as the weather events continue. In the meantime, we also believe that paying attention to the human side of weather catastrophes is just as important. We send our thoughts and best wishes to everyone affected by these storms, and we hope for as swift a recovery as possible.

Should you have any questions or concerns about how severe weather events could affect your financial future, we are always ready to talk.

ECONOMIC CALENDAR

Tuesday: JOLTS

Wednesday: PPI-FD

Thursday: Consumer Price Index

Friday: Retail Sales, Industrial Production, Business Inventories, Consumer Sentiment