The Weekly Update

Week of September 18, 2017

By Christopher T. Much, CFP®, AIF®

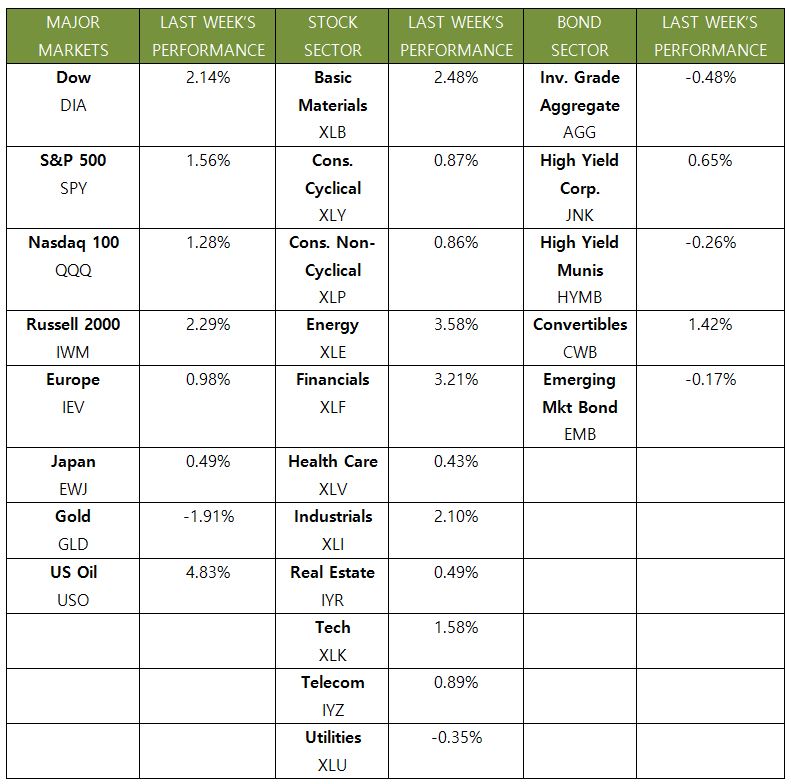

After briefly stumbling the week of September 4, domestic indexes notched significant gains last week and hit record highs. By Friday, the S&P 500 exceeded 2,500 for the first time, the Dow closed at its highest level ever, and the NASDAQ reached an intraday record. Each of the indexes gained well over 1% for the week, with the S&P 500 adding 1.58%, the Dow jumping 2.16%, and the NASDAQ increasing 1.39%. International stocks in the MSCI EAFE also performed well, with a weekly gain of 0.55%.

When looking at these sizable increases, you might expect that positive data and geopolitical calm filled the news last week. Instead, we experienced a number of occurrences that could have derailed stock performance:

- North Korea tested another missile

- London experienced a terrorist attack

- Industrial production declined in August

- Retail sales fell in August

So, why did stocks rise despite these less-than-stellar updates?

Of course, it goes without saying that the markets are incredibly complex. You can rarely, if ever, point to a single reason for their performance. Still, a few details may help put this week’s seemingly incongruous gains into perspective.

- Investors mostly ignored North Korea and the London bombing.

Rather than running to less volatile investments after both geopolitical events, typical havens actually declined. After over a dozen North Korean missile tests and multiple London terror attacks this year, investors may simply be feeling complacent about these occurrences. Instead, many are looking to the Fed’s meeting this week as a market catalyst. - Weather affected industrial production and retail sales.

Hurricane Harvey likely pushed down both industrial production and retail sales in August, meaning these data-declines may be temporary. In addition, mild weather on the East Coast meant less air conditioner use—decreasing utility output for industrial production. - The Consumer Price Index (CPI) jumped.

After missing expectations for five months in a row, the CPIa measure of inflationbeat estimates for August. If upcoming months continue this positive performance, which the hurricanes make more likely, the Federal Reserve may be more likely to raise interest rates in December.

What is on the horizon?

Hurricanes Harvey and Irma could continue to affect economic data in the fourth quarter by driving down retail sales and increasing the Consumer Price Index. We may need to wait a few months before we can see the true trends underlying the data. For now, we will continue to track market performance and investor sentiment, and seek out accurate information amidst the hype.

ECONOMIC CALENDAR

Monday: Housing Market Index

Tuesday: Housing Starts

Wednesday: Existing Home Sales, FOMC Meeting Announcement

Friday: PMI Composite Flash