The Weekly Update

Week of May 19th, 2025

By Christopher T. Much, CFP®, AIF®

Stocks roared higher last week, powered by upbeat trade news and tame inflation reports.

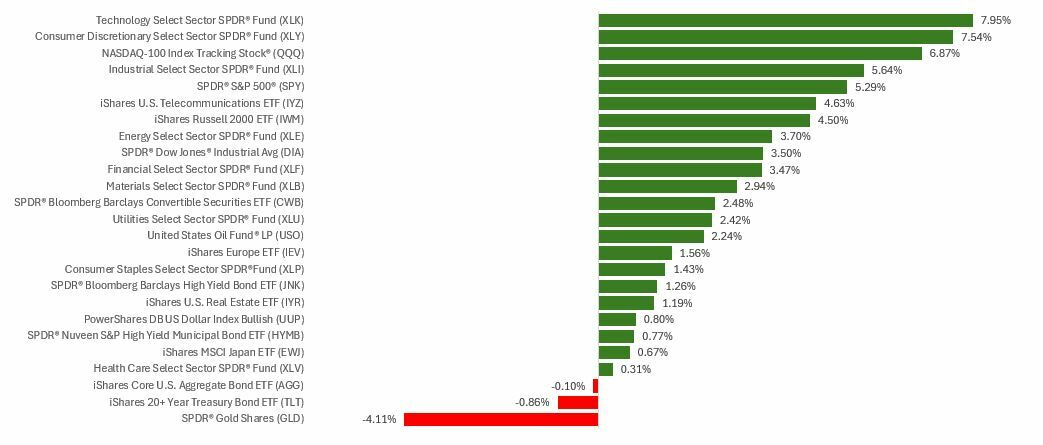

The Standard & Poor’s 500 Index rose 5.27 percent, while the Nasdaq Composite Index spiked 7.15 percent. The Dow Jones Industrial Average added 3.41 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, increased 0.80 percent.

S&P, Dow Erase YTD Losses

Stocks pushed higher on Monday as investors cheered weekend news that the U.S. and China temporarily agreed to back off steep reciprocal tariffs.

Then, a mild inflation report for April—the slowest annualized Consumer Price Index (CPI) reading in four years—boosted markets on Tuesday. Tech stocks powered the rally as the S&P 500 closed trading in the green for the year.

Markets closed the week with modest gains, largely looking past weak consumer sentiment data released on Friday.

Friday was the Dow’s turn to erase year-to-date losses and get back in the green while the Nasdaq and S&P notched a five-day winning streak.

All Eyes on Economic Data

The retail (CPI) and wholesale inflation reports (Producer Price Index) were mild, although most economists didn’t expect tariffs to impact prices in the first month of implementation.

Retail sales ticked up slightly (as expected), while industrial production and housing starts showed signs of tariff impact.

Expect traders to continue to closely watch economic reports to better understand whether tariffs are showing up in the data.

This Week: Key Economic Data

Monday: New York Fed President John Williams, Dallas Fed President Lorie Logan, and Atlanta Fed President Raphael Bostic speak. Leading Economic Indicators. E-Commerce Retail Sales.

Tuesday: Richmond Fed President Thomas Barkin, Raphael Bostic, and Fed Governor Adriana Kugler speak. Financial Markets Conference.

Wednesday: Thomas Barkin speaks. 20-Year Treasury Bond Auction.

Thursday: Existing Home Sales. Jobless Claims (weekly). PMI Composite—Services and Manufacturing. John Williams speaks. Fed Balance Sheet.

Friday: New Home Sales. Kansas City Fed President Jeff Schmid and Fed Governor Lisa Cook speak.

Source: Investor’s Business Daily – Econoday economic calendar; May 16, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: The Home Depot, Inc. (HD), Palo Alto Networks, Inc. (PANW)

Wednesday: The TJX Companies Inc. (TJX), Lowe’s Companies, Inc. (LOW)

Thursday: Intuit Inc. (INTU), Analog Devices, Inc. (ADI), The Toronto Dominion Bank (TD), Workday, Inc. (WDAY)

Source: Zacks, May 16, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.