The Weekly Update

Week of March 25, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Friday, the yield of the 3-month Treasury bill exceeded the yield of the 10-year Treasury note for the first time in 12 years. For some analysts, this “inverted yield curve” may imply a short-term lessening of confidence. (Treasury yields move inversely to Treasury prices.)

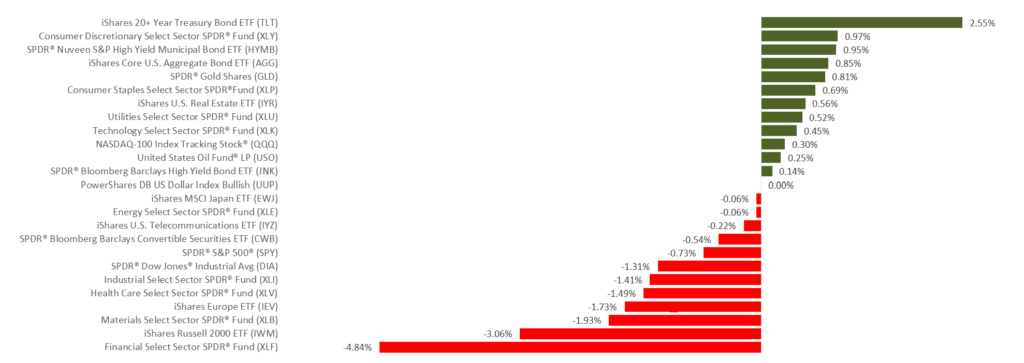

As a result, the S&P 500 ended the week 0.94% lower. The Nasdaq Composite fell 0.80%, and the Dow Industrials lost 1.19%.

In contrast, the MSCI EAFE index following international stocks rose, gaining 0.52% for the week.

Fed Sees No Hikes in 2019

On Wednesday, the Federal Reserve held interest rates steady, but lowered its estimate of 2019 economic growth to 2.1%.

Last December, the central bank forecast two rate hikes in 2019. It now expects to leave rates unchanged this year, with one quarter-point hike projected for 2020.

This pivot may acknowledge a slight change in economic conditions. The Fed’s latest policy statement noted that the “growth of economic activity has slowed from its solid rate in the fourth quarter.”

Oil Hovers Near $60

At Friday’s closing bell, a barrel of West Texas Intermediate (WTI) crude oil was valued at $58.85 on the New York Mercantile Exchange (NYMEX). Its value briefly climbed to $60 earlier in the week.

Month-over-month, the price of WTI crude has risen nearly 5%. Historically, higher oil prices can have a significant impact on retail gasoline prices.

What’s Next

A U.S. delegation is scheduled to accompany Treasury Secretary Steven Mnuchin to China this week for further trade negotiations. Finally, Brexit will not occur this Friday, as the European Union has extended the United Kingdom’s deadline in response to Prime Minister Theresa May’s request.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: The Conference Board’s latest reading on consumer confidence.

Thursday: February pending home sales, and the federal government’s second estimate of fourth-quarter Gross Domestic Product (GDP).

Friday: Reports on consumer spending and new home sales, and March’s final University of Michigan consumer sentiment index, another measure of consumer confidence levels.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Winnebago (WGO)

Tuesday: KB Home (KBH)

Wednesday: Lennar (LEN), Lululemon Athletica (LULU), Paychex (PAYX)

Thursday: Accenture (ACN)

Friday: Blackberry (BB), CarMax (KMX)