The Weekly Update

Week of August 20, 2018

By Christopher T. Much, CFP®, AIF®

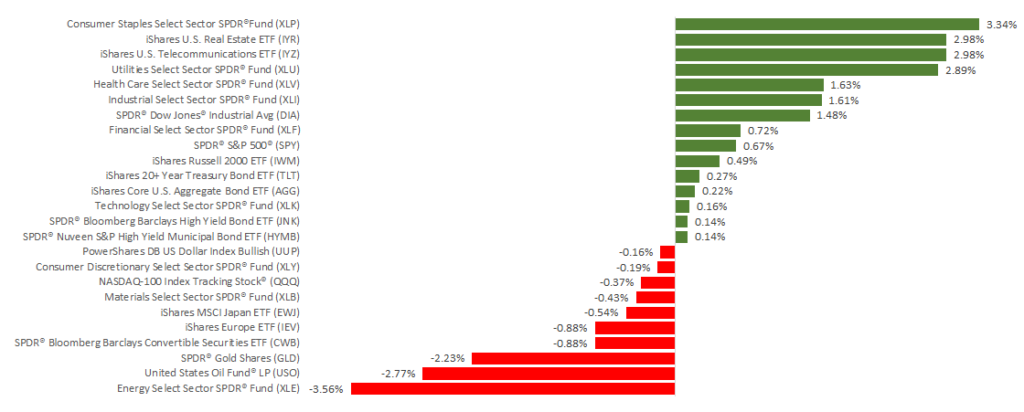

Challenges in emerging markets affected both U.S. and global stock performance last week, with the S&P 500 experiencing several down days. By market close on Friday, however, two of the three major domestics posted gains for the week. The S&P 500 added 0.59%, the Dow increased 1.41%, and the NASDAQ lost 0.29%. Meanwhile, the MSCI EAFE international stocks slipped 1.18%.

As several reports deepened our understanding of the economy’s underlying health, investors balanced the news with updates on Turkey and trade disputes. Here are some key highlights of the various developments:

Economy: Mixed Picture

The latest unemployment data beat expectations, indicating continuing strength as the labor market is near full employment. However, new home construction missed its 7.4% projected growth, increasing only 0.9% in July—following June’s 12.3% decline. Nevertheless, more positive news emerged: Thanks to tax cuts, a solid labor market, and economic growth, retail sales increased 6.4% in July year-over-year. Retail sales have now risen for the past 6 months.

Turkey: Sanctions and a Tumbling Lira

On Monday, August 13, the Turkish lira hit its lowest point ever against the U.S. dollar. The U.S. has threatened more sanctions on Turkey if the country does not release U.S. Pastor Andrew Brunson. In addition, Turkey’s inflation is swelling, and President Recep Tayyip Erdogan may be suppressing the central bank’s ability to increase interest rates. The lira may continue to decline in value until interest rates rise. Some analysts are optimistic that these developments won’t create contagion in other markets. Not only is Turkey’s economy relatively small and investors have priced in some risk, opportunities still exist to help calm Turkey’s challenges.

Trade Update: Positive Movement

Later in the week, we received positive updates on trade challenges with China and the North American Free Trade Agreement (NAFTA). Mexican economy minister, Ildefonso Guajardo, announced that he hoped to finalize some NAFTA negotiations by this week. In addition, officials from the U.S. and China will be meeting in Washington, D.C. this week to discuss the ongoing trade disputes. These talks come before the anticipated meeting in November between President Trump and Chinese Leader Xi. A trade war with China has been one of the market’s largest concerns, so if the tension lessens, that is likely good news for equities.

Looking Ahead

This week, we’ll receive more information about the housing market that reveals how this key industry is currently performing. We will also continue to track developments in trade and Turkey. As always, if you have any questions about what you read here – or what you’re hearing elsewhere – we’re available to talk.

ECONOMIC CALENDAR:

Wednesday: Existing Home Sales

Thursday: New Home Sales, Jobless Claims

Friday: Durable Goods Orders