The Weekly Update

Week of November 10th, 2025

By Christopher T. Much, CFP®, AIF®

Stocks hit a rough patch last week as fresh labor market data, low consumer sentiment, and the ongoing government shutdown unnerved investors.

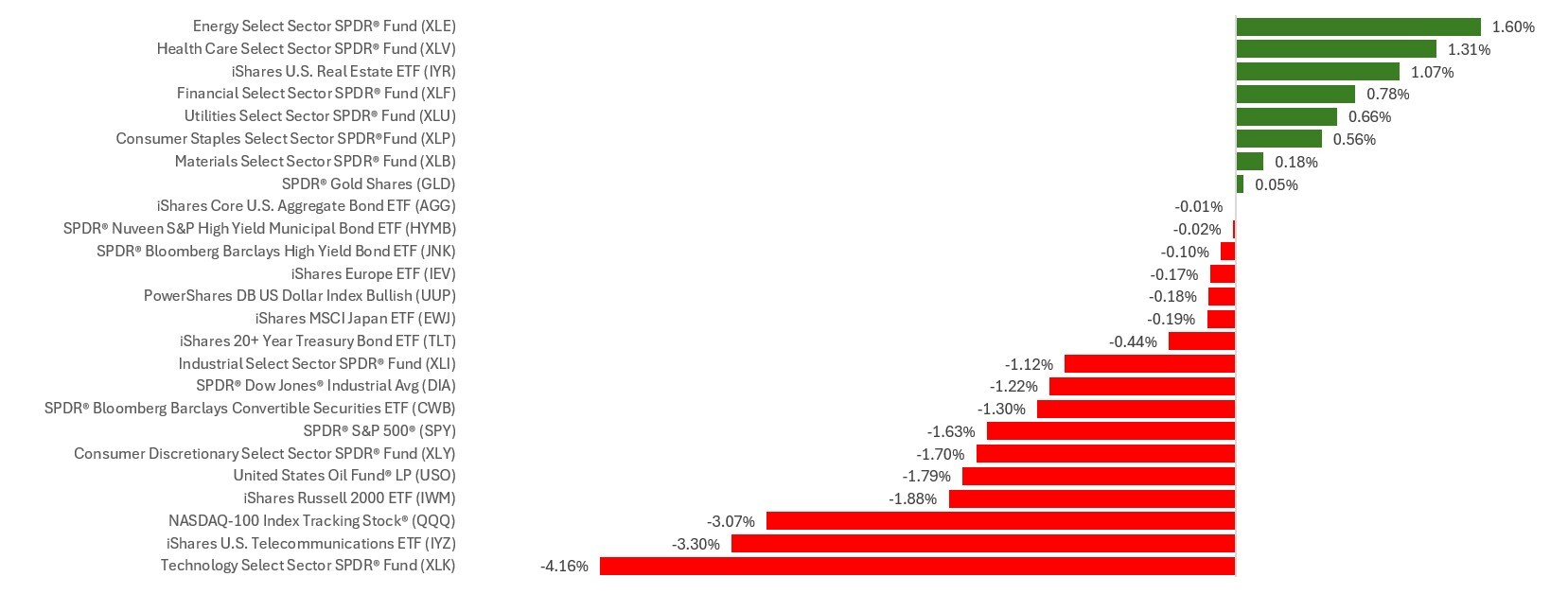

The Standard & Poor’s 500 Index declined 1.63 percent, while the Nasdaq Composite Index dropped 3.04 percent. The Dow Jones Industrial Average fell 1.21 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, edged down 0.83 percent.

Nasdaq’s Toughest Week Since April

Stocks started the week mixed. The S&P 500 and Nasdaq each rose modestly, while the Dow Industrials fell.

Markets stabilized midweek after an ADP jobs report showed stronger-than-expected hiring by private employers in October. The report buoyed investor sentiment, pushing all three major averages higher.

However, stocks fell as investor concerns over stock valuations persisted, particularly among companies related to AI. Following a well-known outplacement firm’s report of a steep increase in corporate layoffs, selling pressure intensified as investors continued to react to data updates from alternative sources in the absence of official government data.

Stocks slid again on Friday after news that consumer sentiment hit its lowest level in three years. The survey data appeared to exacerbate investor nerves about the reading’s connection to a fragile labor market and the impacts of the government shutdown.

But all three major averages then began a recovery rally midday Friday, with the S&P and Dow Industrials climbing back into the green and the Nasdaq regaining nearly all its losses by the closing bell.

Labor Market Paradox

Payroll processing company ADP’s monthly employment report has become a prominent alternative source for jobs data in the wake of the government shutdown. However, it doesn’t always tell the whole story.

ADP’s latest jobs report showed private employers hired at a much stronger pace than expected in October. U.S. companies added 42,000 jobs in October, nearly double the 22,000 new jobs economists expected. Given that 29,000 jobs went away in September, the October figure was welcome news for investors; it was also the first increase in three months. The bulk of the job gains came from the trade, transportation, utilities, education, and health sectors.

Other data out last week told a different story. Another report showed layoff announcements in October hit a 22-year high for the month, making this year the worst for layoffs since 2009.

This Week: Key Economic Data

Tuesday: NFIB Small Business Optimism Index.

Wednesday: Federal Reserve Presidents Anna Paulson (Philadelphia) and Raphael Bostic (Atlanta) speak.

Thursday: Weekly Jobless Claims.* Consumer Price Index (CPI).* Fed Presidents John Williams (New York), Alberto Musalem (St. Louis), Beth Hammack (Cleveland), and Raphael Bostic (Atlanta) speak. Federal Budget.

Friday: Retail Sales.* Producer Price Index (PPI).* Business Inventories.* Fed Presidents Jeff Schmid (Kansas City) and Lorie Logan (Dallas) speak.

* Data for these indicators may be delayed or altogether unavailable due to the government shutdown.

Source: Investor’s Business Daily – Econoday economic calendar; November 7, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: CoreWeave Inc. (CRWV), Barrick Mining Corporation (B)

Wednesday: Cisco Systems, Inc. (CSCO), Transdigm Group Incorporated (TDG), Manulife Financial Corp (MFC)

Thursday: The Walt Disney Company (DIS), Applied Materials, Inc. (AMAT), Brookfield Corporation (BN), NetEase, Inc. (NTES)

Source: Zacks, November 7, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.