The Weekly Update

Week of April 15, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

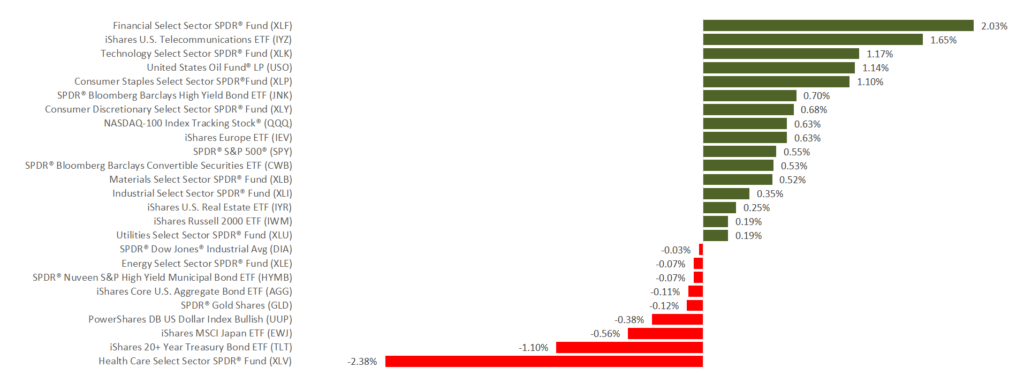

Stocks broke out of a narrow range on Friday following news that two major banks grew their bottom line in the first quarter. For the week, the S&P 500 rose 0.79%; the Nasdaq Composite, 0.91%. The Dow Jones Industrial Average improved 0.50%. Turning to overseas stocks, the MSCI EAFE index declined 0.09%.

The market spent much of the week in a lull as investors waited for earnings season to begin. Wall Street is paying close attention to both guidance and profit margins.

Big Banks Post Solid Results

Friday, Wells Fargo and JPMorgan Chase both reported Q1 profit growth, and JPMorgan Chase announced record revenue.

This was welcome news. Analysts have tempered some of their expectations entering this earnings season, recognizing that slowing global growth, tariffs, and dollar strength may be affecting corporate profits. The dollar rallied 6.2% in Q1.

Inflation Picks Up

The Consumer Price Index rose 0.4% in March, the most in 14 months. This matched the consensus forecast of economists polled by MarketWatch, who believed rising gas prices would affect the number.

Even with this March jump, annual inflation remained relatively tame at 1.9%.

What’s Ahead

Note that U.S. stock and bond markets will be closed on Good Friday (April 19).

THE WEEK AHEAD: KEY ECONOMIC DATA

Thursday: March retail sales.

Friday: March housing starts and building permits.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Citigroup (C), Goldman Sachs (GS)

Tuesday: Bank of America (BAC), BlackRock (BLK), Comerica (CMA), IBM (IBM), Johnson & Johnson (JNJ), Netflix (NFLX), UnitedHealth Group (UNH)

Wednesday: Abbott Labs (ABT), Alcoa (AA), Bank of New York Mellon (BNY), Morgan Stanley (MS), PepsiCo (PEP), U.S. Bancorp (USB), United Rentals (URI)

Thursday: American Express (AMEX), Honeywell (HON), Manpower (MAN), Philip Morris (PM), Schlumberger (SLB), Travelers Companies (TRV), Union Pacific (UNP)