The Weekly Update

Week of June 25, 2018

By Christopher T. Much, CFP®, AIF®

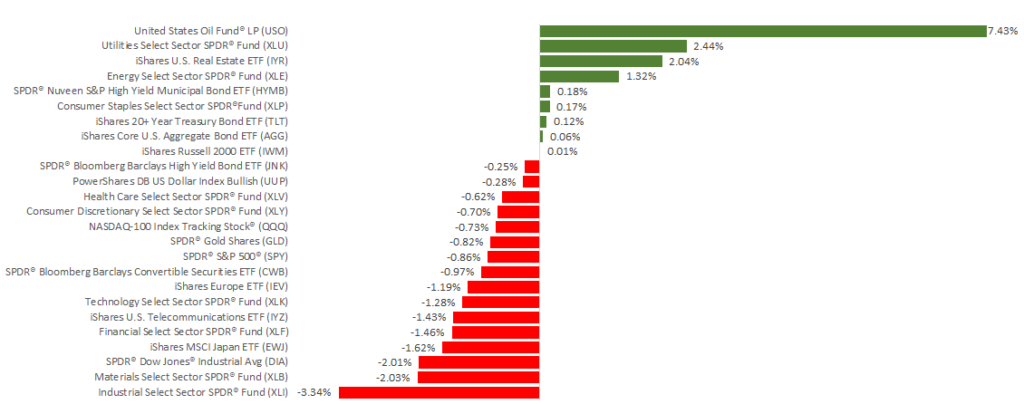

Stocks stumbled across the globe last week as trade tensions continued to escalate. Despite rebounding somewhat on Friday, the S&P 500 experienced its first weekly loss in a month, and the Dow posted its worst week since March. The S&P 500 dropped 0.89%, the Dow lost 2.03%, and the NASDAQ fell 0.69%. International stocks in the MSCI EAFE gave back 0.98%.

While trade headlines may affect market performance, a closer look at the data shows other, more powerful drivers affecting equity prices. In particular, many investors continue to focus on corporate earnings estimates.

Analyzing Corporate Earnings

Strong corporate earnings have helped maintain a sense of market balance in 2018. As the media focuses on political stories, corporate earnings estimates continue to rise—and have a greater market affect than many investors may recognize.

How Corporate Earnings Estimates Work

Many financial services companies hire analysts to predict how much a company’s stock will earn per share. The average of all the experts’ predictions creates a consensus earnings estimate. This calculation gives a rough view of the company’s cash flow—which helps investors value a stock. Generally, when a company beats its earnings estimate, the stock price goes up. If it misses or matches the prediction, the stock may suffer.

Where We Are Now

Tax cuts and increasing demand have helped earnings estimates grow this year. As the estimates have risen, companies with the largest increases are significantly outperforming those with the worst. The latest numbers show earnings per share growing in 2019 and 2020—and 2018’s projections are higher than they were at the end of the 1st quarter. This data has helped keep markets from overreacting to the geopolitical buzz in the background.

Looking Forward

While we expect to hear more on a potential trade war, we will continue to focus on key market principals. This week, we will receive several reports, including consumer confidence and durable goods orders. Rather than significantly affecting stocks, these releases may simply underscore what corporate earnings and other data continue to demonstrate: Right now, the economy is healthy.

Next month, earnings season will begin, and analysts expect S&P 500 companies to show 20% profit growth in the 2nd quarter.

Looking ahead, we will continue to analyze how rising tariffs could affect the domestic and global markets. But, as always, economic fundamentals will take the lion’s share of our attention.

If you have questions about earnings, trade, or your future, contact us any time.

ECONOMIC CALENDAR:

Tuesday: Consumer Confidence

Wednesday: Durable Goods Orders

Thursday: GDP, Jobless Claims

Friday: Personal Income and Outlays, Consumer Sentiment