The Weekly Update

Week of August 27, 2018

By Christopher T. Much, CFP®, AIF®

Last week marked a noteworthy milestone in our economy: On Wednesday, August 22, the bull market entered its 3,453rd day, the longest such run in U.S. history. In the past 9 plus years, domestic indexes have come quite a way since the dark days of the financial crisis. The S&P 500 is now more than 4 times the level that it was when the bull market began on March 9, 2009.

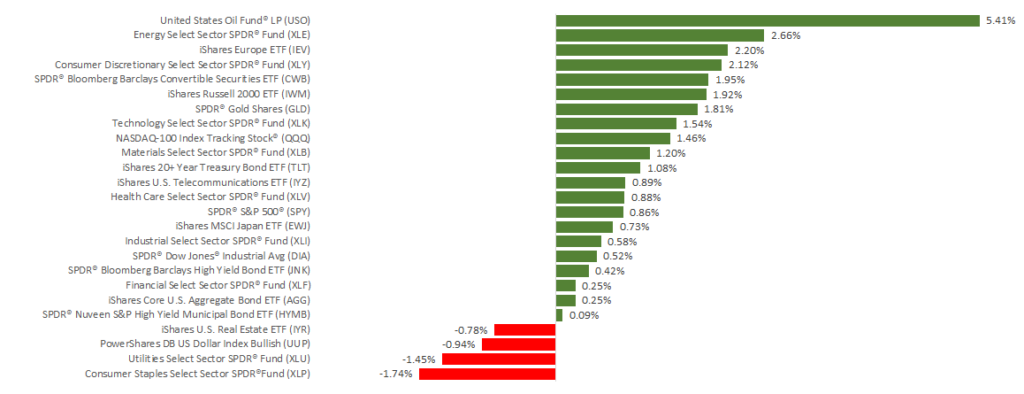

In fact, both the S&P 500 and NASDAQ closed last week with new record highs. The S&P 500 added 0.86%, the Dow increased 0.47%%, and the NASDAQ gained 1.66%. International stocks in the MSCI EAFE also grew, increasing 1.52% for the week.

This domestic growth occurred against a backdrop of geopolitical events. Investors considered new tariffs between China and the U.S., as well as legal developments potentially related to President Trump. However, economic updates seemed to hold the most sway over market performance last week.

What did we learn about the economy last week?

Beyond passing a major milestone in the bull market, we also received some key economic updates, including:

- The Fed’s interest rate increases should continue at a gradual pace.

In talks last week, Fed Chairman Jerome Powell called the economy “strong” and said inflation isn’t overheating. He indicated the central bank intends to maintain its current pace of interest-rate raises. Markets increased after his remarks. - The labor market remains strong.

New claims for unemployment fell for the 3rd week in a row and were below expectations, continuing on July’s trend that included the lowest numbers since 1969. This data indicates that, despite U.S. companies facing ongoing trade tension, the labor market remains on solid ground. - Business investment may be on the rise.

Data for durable goods orders includes details that can hint at how businesses plan to approach spending. This so-called “non-defense capital goods excluding aircraft” grew far more than anticipated in July. The reports indicate that business investments started the 3rd quarter on solid ground.

These updates may help support economists’ perspectives that the bull market still has life left. If you have questions about where your financial life stands today and, in the future, we’re here to talk.

ECONOMIC CALENDAR:

Tuesday: Consumer Confidence

Wednesday: GDP

Thursday: Personal Income and Outlays, Jobless Claims

Friday: Consumer Sentiment