The Weekly Update

Week of April 12th, 2021

By Christopher T. Much, CFP®, AIF®

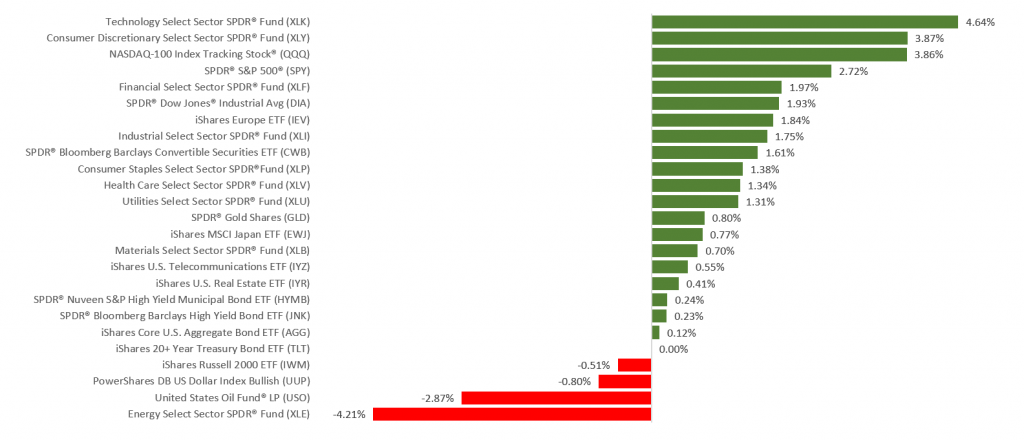

Strong economic data and a resurgent technology sector propelled stocks to solid gains last week.

The Dow Jones Industrial Average advanced 1.95%, while the Standard & Poor’s 500 picked up 2.71%. The tech-heavy Nasdaq Composite index gained 3.12%. The MSCI EAFE index, which tracks developed overseas stock markets, gained 1.96%.

Technology Leads

A blow-out jobs report and an all-time high in the ISM-Services Index, coupled with the continued rebound in technology stocks, powered the Dow Industrials and S&P 500 to record highs to open a new week of trading.

After taking a breather mid-week, stocks resumed their climb amid lower bond yields, widening momentum in vaccination efforts, and falling concerns over corporate tax rate hikes. As bond yields settled lower, technology shares rallied, lifting the S&P 500 to another record high on Thursday, its 19th closing record high this year.

Despite a surge in March producer prices, stocks added to their gains to close out a strong week of performance.

Two Steps Forward, One Step Back

The labor market has been perhaps one of the more tenuous ingredients in the budding economic recovery, though recent employment data may suggest the labor market recovery is gathering steam.

March’s employment report exceeded all expectations, posting an increase of 916,000 in nonfarm payrolls, with upward revisions of 156,000 jobs to the January and February increases. Later, the JOLTS (Job Openings and Labor Turnover Survey) report saw a jump in job openings at a level not seen in two years. The weekly new jobless claims report, however, was mixed, as jobless claims came in higher than estimated, while continuing claims fell below the level seen just prior to the wave of pandemic-induced layoffs in late March 2020.

This Week: Key Economic Data

Tuesday: Consumer Price Index (CPI).

Wednesday: Federal Open Market Committee (FOMC) Minutes.

Thursday: Jobless Claims. Retail Sales. Industrial Production.

Friday: Housing Starts. Consumer Sentiment.

Source: Econoday, April 9, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: J.P. MorganChase (JPM), Goldman Sachs (GS), Wells Fargo (WFC).

Thursday: Bank of America (BAC), UnitedHealthcare Group (UNH), Citigroup (C), Alcoa (AA), BlackRock, Inc. (BLK), Taiwan Semiconductor (TSM), J.B. Hunt Transportation (JBHT).

Source: Zacks, April 9, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.