The Weekly Update

Week of December 25, 2017

By Christopher T. Much, CFP®, AIF®

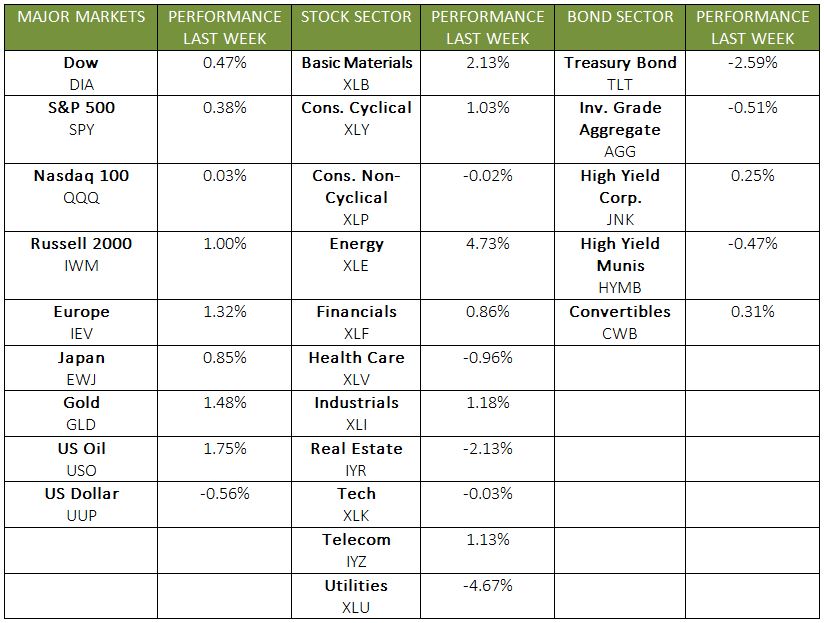

As we headed into the long holiday weekend, the markets continued to climb as tax reform moved forward. For the week, the S&P 500 closed up 0.29%, the Dow rose 0.43%, and the NASDAQ gained 0.35%. International stocks in the MSCI EAFE increased by 1.23%.

Before leaving for his holiday vacation, President Trump signed a new tax bill and a measure to temporarily delay a possible government shutdown. Supporters of the $1.5 trillion tax cut, which dramatically reduces the corporate tax rate, believe it will encourage businesses to invest, hire more workers, and increase wages. Some companies are already celebrating by offering bonuses to their employees and promising to improve infrastructure in the workplace.

Tax Bill Highlights

The historic bill is the largest tax revamp in more than 30 years and makes several changes to the federal tax system, including:

- Lowers corporate tax rate from 35% to 21%

- Offers pass-through businesses a 20% tax deduction

- Cuts top individual tax rate

- Increases standard deduction and child tax credit

- Limits state and local tax deductions

Other Economic News

Though popular cryptocurrencies experienced volatility, strong economic news helped round out the week on a positive note.

Housing Picks Up: Home sales rose in November, with new home sales recording the largest jump in 25 years. Existing home sales also beat analyst forecasts and jumped to the highest rates seen during the economic expansion. The housing numbers mirror the solid, year-long market performance.

GDP Grows: We received the final reading of 3rd quarter Gross Domestic Product, which showed the economy grew 3.2% between July and September. Data suggests—thanks to a strong housing market—that 4th quarter GDP should rise by 3% as well.

What’s Ahead

With consumer confidence at a 17-year high, investors remain hopeful that the markets will ring in the New Year in good shape. We will see more housing news along with an update on current consumer confidence.

Over the holidays, we’ll keep tabs on the markets and look toward economic developments in 2018. As always, please contact us if you have any questions.

ECONOMIC CALENDAR

Monday: Markets Closed for Christmas Day

Wednesday: S&P CoreLogic Case-Shiller Home Price Index, Consumer Confidence, Pending Home Sales Index

Thursday: Jobless Claims