The Weekly Update

Week of December 11, 2017

By Christopher T. Much, CFP®, AIF®

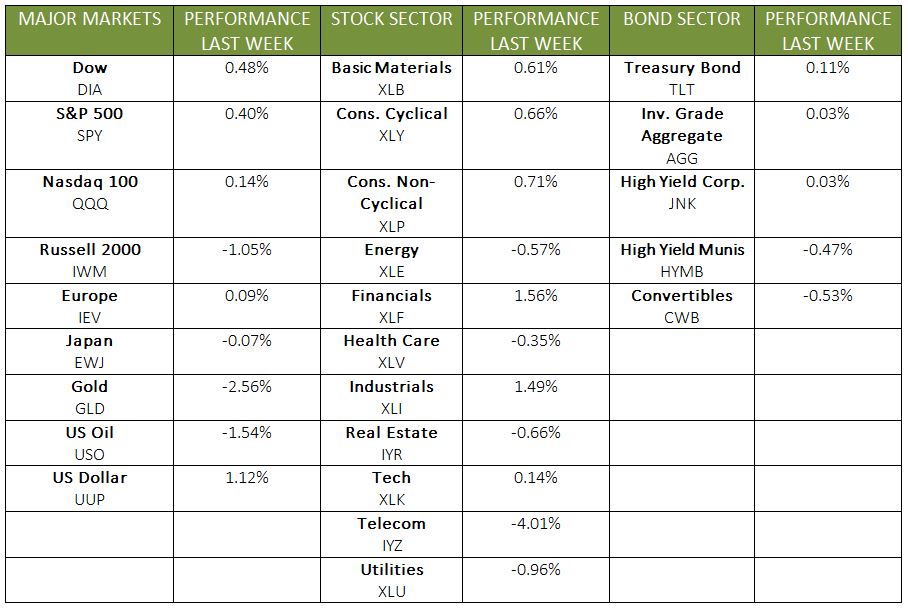

As the holiday season progresses, the markets continue to impress. Last week, many energy, financial, and industrial sector stocks helped drive performance. Hitting record highs yet again, the S&P gained 0.35%, and the Dow jumped 0.40% for the week. Meanwhile, the NASDAQ fell slightly by 0.11%, and the MSCI EAFE rose 0.08%.

Solid labor market conditions and a rebounding retail climate are helping to support the economy as the year closes. Here are some developments that stood out last week:

Promising Labor Market Numbers

Encouraging news came on Friday when we learned that nonfarm payroll jobs rose more than expected in November, coming in at 228,000. Manufacturers have created almost 200,000 new jobs in the last 12 months and 1 million new factory jobs since 2010. We have now had 86-straight months of job gains, the longest stretch in U.S. history.

This growth in new jobs has helped to keep unemployment down, which remains at a 17-year low of 4.1%. Additionally, average hourly wages have increased by 2.5% for the year.

Retail Climate in Positive Territory

As the job market expands and people have more spending power, we’re experiencing a robust retail climate. Retail stocks are rebounding after a long market lag, and holiday shopping is strong this season with predicted growth from 3.6% to 4% over last year. Further, brick-and-mortar shops are even feeling the shopping strength, emerging as some of the best performing retail investments, despite their general drop in 2017.

What Lies Ahead

Now that Congress has avoided a government shutdown—at least for a few weeks—the Senate and the House can focus on the tax bill. While progress has been made, they still need to negotiate the financial bill’s terms.

Next week, investors will follow the Fed to see if it raises interest rates, as expected. In addition, the Fed could also comment on inflation expectations and address concerns about potential asset bubbles.

As the holidays wind up, we will continue to monitor the markets and focus on the fundamentals. If you have questions about how this news affects your financial life, we’re here to talk. Feel free to contact us and find the answers you need.

ECONOMIC CALENDAR

Monday: JOLTS

Wednesday: Consumer Price Index, FOMC Meeting Announcement

Thursday: Jobless Claims, Retail Sales, Business Inventories

Friday: Empire State Mfg Survey, Industrial Production