The Weekly Update

Week of May 29, 2018

By Christopher T. Much, CFP®, AIF®

Geopolitical uncertainty affected stocks last week, as the historic summit between the U.S. and North Korea began to look less likely. On Thursday, May 24, President Trump announced that the summit was off, and stocks stumbled in reaction. The next day, Trump said the meeting might still occur next month, leaving investors questioning the eventual outcome.

Also, on the geopolitical front, an announcement that Saudi Arabia and Russia would consider easing back oil supply restrictions affected stocks. U.S. crude oil prices dropped in response, pulling energy stocks down with them.

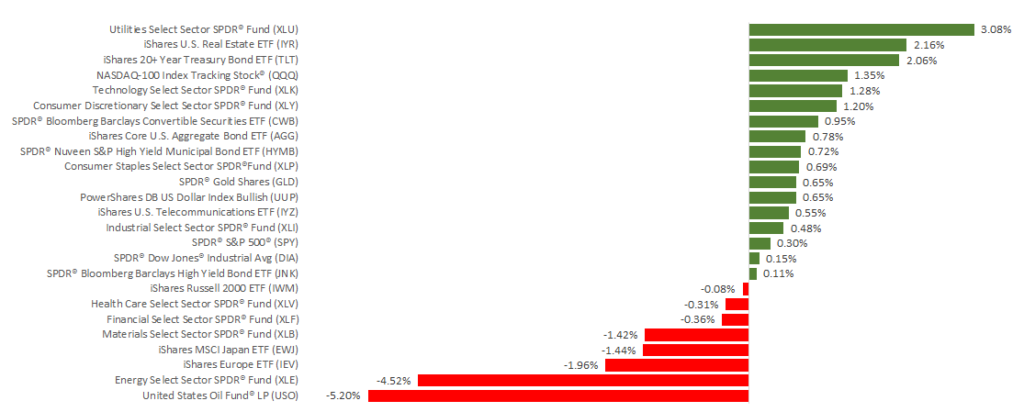

Despite these developments, major domestic indexes increased last week. The S&P 500 gained 0.31%, the Dow added 0.15%, and the NASDAQ grew by 1.08%. International stocks dropped, with the MSCI EAFE decreasing by 1.60%.

What kept U.S. stocks in positive territory for the week?

Solid corporate earnings helped drive upward movement.

Several companies experienced double-digit stock growth last week after releasing their latest data. This strong performance helped balance the declines and uncertainty that the week’s geopolitical headlines created.

What other economic perspectives did we receive?

From durable goods to home sales, various data came out last week:

- The factory sector could drive economic growth, as steel and aluminum tariffs are contributing to rising value of orders and inventories for metals.

- Business confidence and 2nd-quarter investment could increase, as strong core durable goods orders may indicate good news for companies.

- Housing is underperforming, as growth in home sales volume and prices have softened recently.

Overall, last week provided a mix of insight about the current economic strength and geopolitical environment. In this week’s 4 trading days, we’ll gain more perspectives on consumer confidence, Gross Domestic Product, manufacturing, and employment. We will use this data to continue building our understanding of what may lie ahead in the markets—and how to prepare our clients for the future. If you have any questions, we are here to talk.

ECONOMIC CALENDAR:

Monday: U.S. Markets Closed for Memorial Day

Tuesday: Consumer Confidence

Wednesday: GDP, ADP Employment Report

Thursday: Jobless Claims

Friday: Employment Situation, PMI Manufacturing Index, ISM Mfg Index, Construction Spending