The Weekly Update

Week of September 17, 2018

By Christopher T. Much, CFP®, AIF®

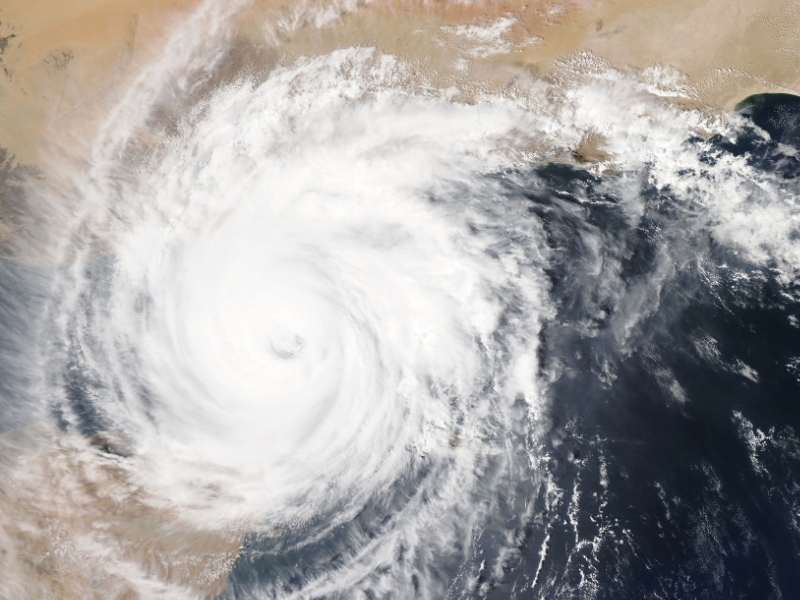

Last week, the East Coast prepared for Hurricane Florence, which roared through the Carolinas and Georgia. As investors kept their eyes on the weather and its potential for destruction, estimates emerged of up to $27 billion in hurricane damage. This potential for damage contributed to insurance companies in the S&P 500 declining last week. While the hurricane likely won’t have a large effect on our economy, its destruction could influence data for months to come.

Meanwhile, last week brought another milestone in our economy: the 10th anniversary of Lehman Brothers’ bankruptcy.

For 158 years, the Wall Street firm weathered the markets’ changes. By 2008, however, various challenges, including excessive risk taking, led to its demise. The firm’s unexpected bankruptcy announcement shocked investors and triggered market panic, leading what was a simmering financial crisis to become the Great Recession. A decade later, the markets are on more solid ground, and banks hold more capital and have stronger regulation. While some experts warn of a potential looming recession, current market performance and economic data indicate just how far we’ve come.

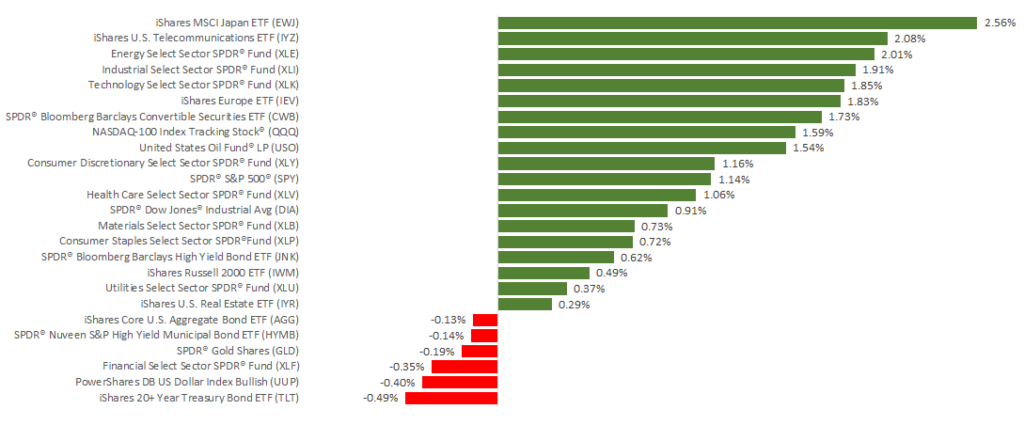

Let’s examine last week’s data to understand examples of where we are today: Domestic indexes rebounded to post healthy gains for the week, with the S&P 500 adding 1.16%, the Dow gaining 0.92%, and the NASDAQ increasing 1.36%. International stocks in the MSCI EAFE were also up, gaining 1.76%.

In addition, we received the following updates, which support a picture of a more robust economy:

- Consumer sentiment jumped: The September reading was at its 2nd-highest point since 2004. The data reveals that consumers expect the economy to grow and create more jobs.

- Retail sales stalled but are primed for growth: Spending barely increased in August, after months of strong growth. However, analysts believe this data is “a blip” rather than an emerging trend, as tax cuts and a healthy labor market leave Americans with money in their pockets.

- Industrial production rose for the 3rd-straight month: Auto manufacturing contributed to higher than expected industrial production in August. For now, trade tensions have not yet hurt this sector.

These data reports may not show blockbuster growth, but together they indicate our economy is doing well. In fact, they were strong enough to lead many economists and analysts to increase their projections of how fast the economy expanded during the 3rd quarter.

Looking back, the markets have come far from where they were 10 years ago. But risks will always remain, as Hurricane Florence and Lehman Brothers remind us. Today and in the future, we are here to help you understand where you are and plan for whatever may lie ahead.

Also, for those affected by the hurricane, we’re ready to support your recovery and provide the financial guidance you seek.

ECONOMIC CALENDAR:

Tuesday: Housing Market Index

Wednesday: Housing Starts

Thursday: Existing Home Sales, Jobless Claims