The Weekly Update

Week of October 15, 2018

By Christopher T. Much, CFP®, AIF®

Volatility was back in full force last week. The three major domestic indexes posted several days of losses before experiencing wide swings on Friday. By week’s end, the Cboe Volatility Index (VIX), which investors use to help measure fear in the markets, had increased by approximately 70%. The VIX also reached its highest point since February.

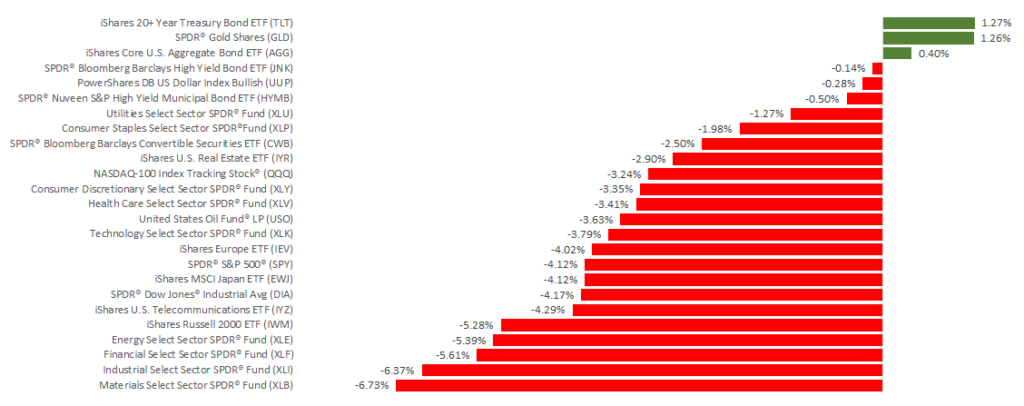

Despite a number of equities posting last-minute gains on Friday, all three domestic indexes had sizable losses for the week. In fact, they posted their worst weekly performance since March. The S&P 500 dropped 4.10%, the Dow declined 4.19%, and the NASDAQ gave back 3.74%. International stocks in the MSCI EAFE also lost ground, decreasing 3.96%.

What drove market performance last week?

As is typically the case, a number of details affected investor sentiment and behavior. The following topics were among the perspectives impacting performance:

- Rising interest rates: In addition to the Fed’s interest rate increases, 10-year Treasury yields are on many investors’ minds. At one point last week, the 10-year reached its highest yields since 2011. As interest from banks and bonds rise, some investors exit the markets in search of more predictable returns. These moves can cause stock prices to drop. However, we want to remind you of what we wrote about last week: Rising rates may bring their own risks, but they are a sign that the economy is growing.

- Falling tech prices: Technology companies have been the best market performers in 2018. However, the sector just experienced its worst weekly results since this spring. With this shift in industry performance, some market participants have begun searching for different ways to invest their money.

- Ongoing trade tension: While many analysts believe interest rates and tech prices drove last week’s losses, some feel that our trade renegotiation with China is to blame. We do not yet know how this skirmish will resolve, but tariffs do have the possibility to slow economic growth and increase prices for consumers.

These concerns and perspectives are important, but they do not give a complete understanding of our current economic conditions. Consumer sentiment remains high, and the latest corporate earnings season is likely to show strong, double-digit earnings growth for companies.

We know that volatility can feel uncomfortable, but it is normal. In the past 38 years, the markets have averaged a 13.8% intra-year decline – yet 29 of those years had positive returns.

As always, we are continuing to monitor economic fundamentals and investor perspectives to find a clear view of where we are today, and what may be ahead. If you have any questions, we are here for you.

ECONOMIC CALENDAR:

Monday: Retail Sales

Tuesday: Industrial Production, Housing Market Index

Wednesday: Housing Starts

Thursday: Jobless Claims

Friday: Existing Home Sales