The Weekly Update

Week of April 15th, 2024

By Christopher T. Much, CFP®, AIF®

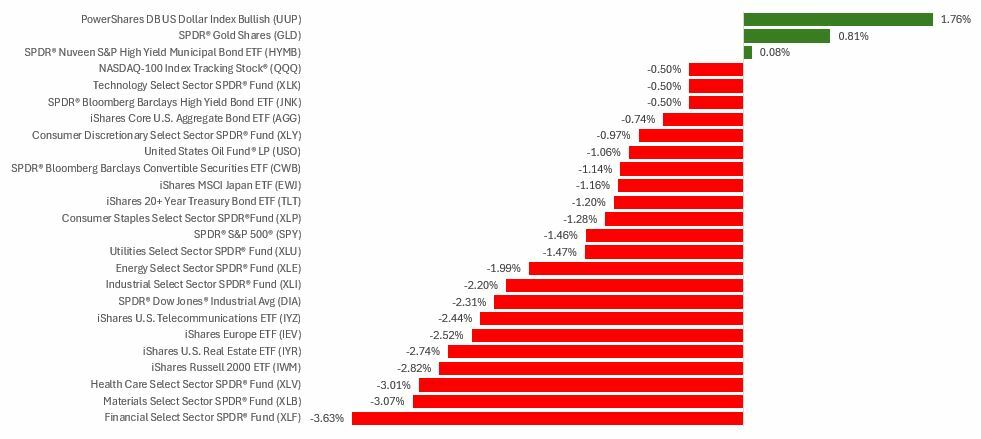

Stocks fell last week as investors sorted through conflicting inflation reports and assessed geopolitical tensions.

Inflation Spooks Markets

On Wednesday, the March Consumer Price Index (CPI) report rattled markets, revealing that inflation accelerated slightly more than expected. Bond yields rose, and stocks retreated in response, as investors feared the news could influence the Fed’s rate decision. The 10-year Treasury yield had its highest intraday jump in three years.

Markets rallied Thursday as investors were encouraged by the Producer Price Index (PPI) report, which measures inflation at the producer level. Unlike CPI, PPI rose less than expected, which sparked a tech-focused rally. Markets opened lower on Friday as investors wrestled with the conflicting inflation reports.

Fears of an escalating Middle East conflict also weighed on stocks during the week. Concerns about a potential weekend event led some investors to end the week in a risk-off position.

Inflated Expectations

Minutes from the March Fed meeting, published Wednesday, showed officials’ concern that inflation wasn’t slowing down quickly enough toward the Fed’s 2% target. But despite sticky inflation, they reiterated that rate cuts were still on the table for this year.

The start of Q1 earnings season reinforced inflation concerns as several leading money center banks—despite many beating expectations—forecasted lower growth for the remainder of 2024 due partly to inflation and higher-than-expected rates.

On Friday, the University of Michigan’s survey showed consumer sentiment fell last month. Some concluded that the survey confirmed what consumers have been saying for months—that inflation is still in their everyday lives.

This Week: Key Economic Data

Monday: Retail Sales. Business Inventories. Housing Market Index. Empire State Manufacturing Index.

Tuesday: Housing Starts and Permits. Industrial Production.

Wednesday: EIA Petroleum Status Report. Treasury International Capital. Beige Book. 20-Year Treasury Bond Auction.

Thursday: Jobless Claims. Existing Home Sales. EIA Natural Gas Report. Philadelphia Fed Manufacturing Index.

Source: Investor’s Business Daily – Econoday economic calendar; April 11, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: The Goldman Sachs Group, Inc. (GS), The Charles Schwab Corporation (CHSW)

Tuesday: UnitedHealth Group Incorporated (UNH), Johnson & Johnson (JNJ), Bank of America Corporation (BAC), Morgan Stanley (MS)

Wednesday: Abbott Laboratories (ABT), Prologis, Inc. (PLD), CSX Corporation (CSX)

Thursday: Netflix, Inc. (NFLX), Elevance Health, Inc. (ELV), Marsh & McLennan Companies, Inc. (MMC), The Blackstone Group (BX)

Friday: The Proctor & Gamble Company (PG), American Express Company (AXP)

Source: Zacks, April 11, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.