The Weekly Update

Week of December 11th, 2023

By Christopher T. Much, CFP®, AIF®

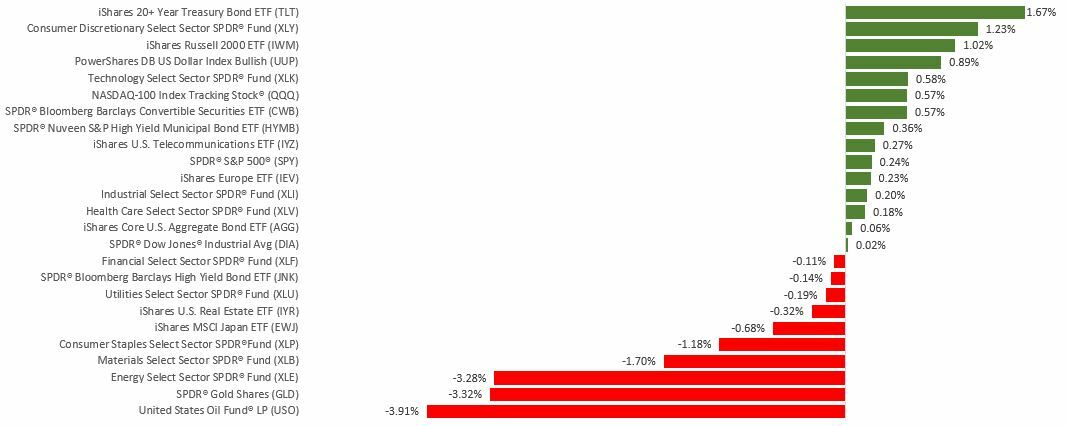

A late-week, two-day rally left stocks higher, adding to November’s gains as the last month of trading for 2023 began.

The Dow Jones Industrial Average was flat (+0.01%), while the Standard & Poor’s 500 gained 0.21%. The Nasdaq Composite index advanced 0.69% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, was up 0.37%.

Stocks Extend Gains

The relationship between the bond and stock markets–which pushed stocks higher in November (i.e., falling bond yields, rising stock prices)–disappeared last week, with stocks falling in the first three days of the week despite declining yields. Yields dropped following a weak job openings report, the ADP employment update, and a substantial productivity revision.

On Thursday, investor enthusiasm returned with force on Artificial Intelligence (AI) related news. One AI chip manufacturer announced a new AI chip, followed by a mega-cap tech company unveiling an enhanced version of its AI model for business use. Stocks continued their climb on Friday despite rising yields, as investors viewed a stronger-than-expected employment report as increasing the potential for a soft landing.

Productivity Surges

Higher productivity may be the most effective and preferred way to reduce inflation. Last week’s revised third-quarter productivity report saw an upward revision of the annualized productivity growth from the initial report of 4.7% to 5.2%; this was welcome news on the inflation front and an encouraging development for future corporate profits.

The 5.2% jump in productivity represented the fastest pace since the third quarter of 2020. The report also showed unit labor costs falling at a 1.2% annualized pace, reflecting a cooling of wage-growth inflationary pressures. Productivity has increased for two straight quarters, potentially allowing the Fed to ease its restrictive monetary policy.

This Week: Key Economic Data

Tuesday: Consumer Price Index (CPI).

Wednesday: Producer Price Index (PPI). FOMC Announcement.

Thursday: Retail Sales. Jobless Claims.

Friday: Industrial Production. Purchasing Managers’ Index (PMI) Composite Flash.

Source: Econoday, December 8, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Wednesday: Adobe, Inc. (ADBE)

Thursday: Costco Wholesale Corporation (COST)

Friday: Lennar Corporation (LEN)

Source: Zacks, December 8, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.