The Weekly Update

Week of November 13, 2017

By Christopher Much, CFP®, AIF®

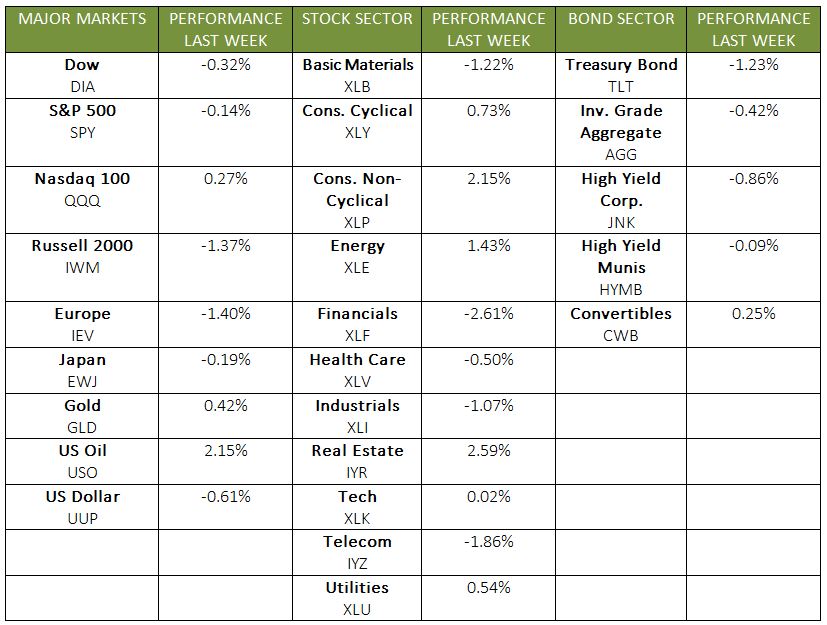

After posting gains every week since September, U.S. stocks declined by market’s close on Friday. The S&P 500 and Dow ended their longest stretch of weekly increases since 2013, and the NASDAQ ended its own 6-week streak. By November 10, the S&P 500 declined 0.21%, the Dow was down 0.50%, and the NASDAQ slipped 0.20%. Meanwhile, the MSCI EAFE dropped by 0.45%.

While these declines are not huge, understanding why stocks dropped after several weeks of steady gains is important. The markets are incredibly complex, so we cannot point to one single detail that drove their performance. We can, however, help you gain insight into what influenced investors’ decisions.

The Market’s Drop in Context

In many ways, uncertainty is to blame for last week’s losses, from a variety of angles:

- Healthcare: Equities dropped as companies continue to analyze changing dynamics in the industry, including potential competition from the tech world. Developments on medical devices and healthcare equipment could create quicker distribution models while decreasing costs, threatening traditional business practices.

- Energy: Tension between Iran, Saudi Arabia, and Lebanon—and the accompanying geopolitical uncertainty—contributed to crude oil prices slipping, which led Energy stocks to lose ground.

- Tax Reform: On Thursday, November 9, the Senate released its tax-reform proposal, which includes significant differences from the current House bill. The Senate’s decision to delay corporate-tax reductions until 2019 led to a stock sell-off. This change from the House bill also fueled concern about the likelihood of fiscal reform moving forward at all.

What Lies Ahead

No one knows exactly when or how taxes may change—and who will experience the greatest impact. For tax reform to occur, the House and Senate will have to work through the number of places where their plans diverge and align their political priorities. At the same time, the Federal Reserve could raise interest rates as many as 4 times over the next year, which could also alter the financial landscape.

In the coming weeks, we will gain more information on tax reform and monetary policy. As we digest information, we will continue focusing on how current circumstances affect clients’ long-term goals. As always, if you have questions about your financial life, contact us anytime.

ECONOMIC CALENDAR

Tuesday: PPI-FD

Wednesday: Consumer Price Index, Retail Sales, Business Inventories

Thursday: Industrial Production, Housing Market Index

Friday: Housing Starts