The Weekly Update

Week of January 22, 2018

By Christopher T. Much, CFP®, AIF®

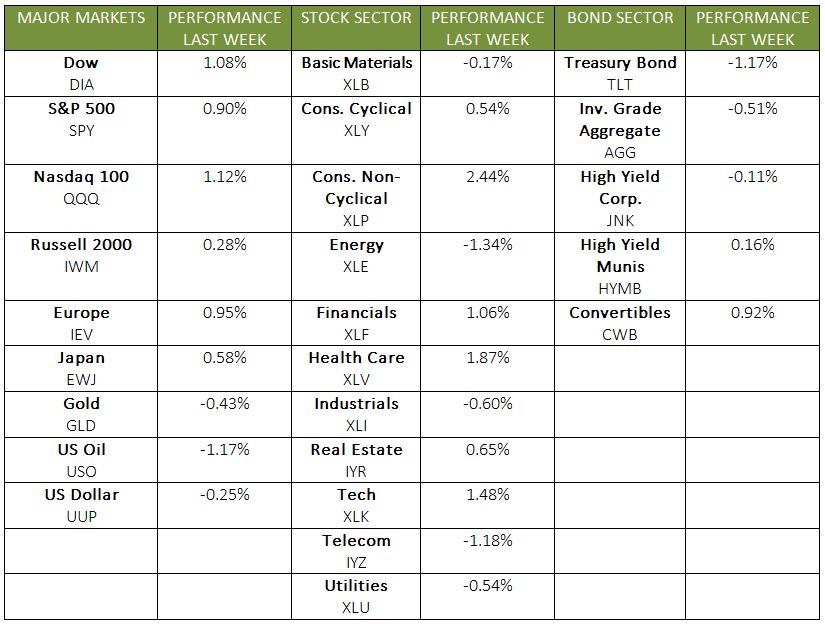

We’re only a few weeks into 2018, and stocks are showing quite a strong performance so far. Last week, major domestic indexes posted gains yet again, with all 3 up at least 5% this year. By Friday, the S&P 500 had added another 0.86%, and both the Dow and NASDAQ were up 1.04%. All 3 indexes hit new record highs at least once during the week.

In addition to the solid performance for U.S. equities, we’re also experiencing synchronized global growth. European and Asian stocks grew last week, and China’s growth data was more positive than expected. Overall, international stocks in the MSCI EAFE added a healthy 1.24% last week. Year to date, the MSCI is up 4.95%.

What happened last week?

Two key topics drove conversations: corporate earnings and a government shutdown.

1. Corporate Earnings

In the U.S., corporate earnings season dominated much of the economic news as reports continue to show companies doing well. For organizations that released their 4th-quarter results, 79% beat earnings projections and 89% exceeded sales estimates.

2. Government Shutdown

The Federal government shut down on Saturday morning, January 20th, after the House and Senate failed to pass a bill to extend funding. This shutdown is the first since 2013.

How did these occurrences affect the markets?

While a potential shutdown loomed last week, overall, investors had little reaction to its possibility. Volatility did increase last week as investors waited to see if the House and Senate would reach a compromise on government funding. However, the solid news from corporate earnings seemed to outweigh concerns about the Federal government. Rather than focusing on drama in Washington, many traders are paying attention to the strength in U.S. corporations’ fundamentals.

As more data unfolds, we will continue to monitor the relationship between government policy and economic performance. As always, if you have any questions about how current events and market developments may be affecting you, contact us any time.

ECONOMIC CALENDAR

Wednesday: Existing Home Sales

Thursday: New Home Sales, Jobless Claims

Friday: Durable Goods Orders, GDP