The Weekly Update

Week of April 24th, 2023

By Christopher T. Much, CFP®, AIF®

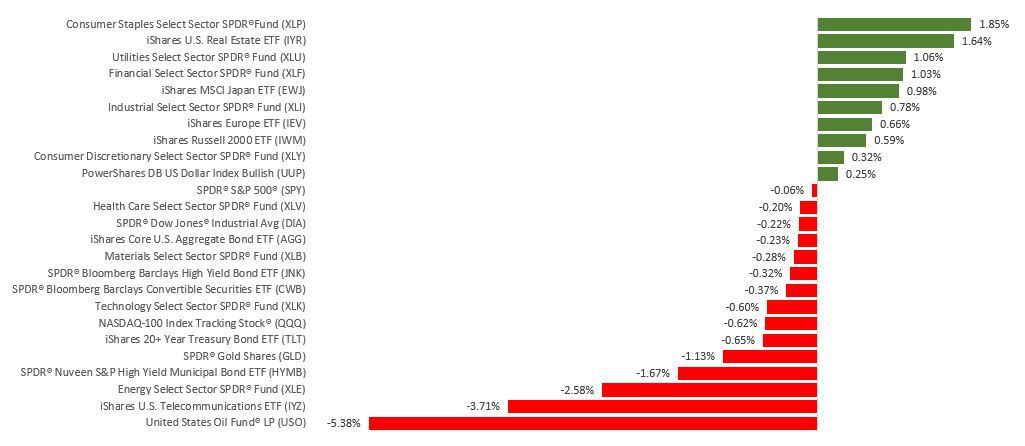

Stocks remained resilient last week amid mixed earnings reports, hawkish Fed-speak, and lingering recession fears, closing out the five trading days with small losses.

The Dow Jones Industrial Average slipped 0.23%, while the Standard & Poor’s 500 lost 0.10%. The Nasdaq Composite index fell 0.42% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, added 0.10%.

Stocks Hold Firm

Stocks traded most of last week around the flatline as investors grappled with several headwinds.

The first was disappointing earnings results, coupled with the absence of earnings guidance from some companies due to an uncertain economic climate. Weak economic data, including declines in housing and leading economic indicators, also weighed on investor sentiment. Finally, multiple Fed officials spoke last week, signaling that inflation remained too high and that further rate hikes may be likely.

Underneath the seemingly placid surface of the major market indices, there was substantial price action at the individual stock and sector level. Poor earnings results hit communication services stocks and regional banks, while margin pressures put pressure on auto stock valuations.

Housing Weakness

Two housing reports reflected ongoing fragility in the housing market and fed prevailing economic slowdown worries.

Sales of new homes fell 0.8% in March, dragged down by a 5.2% slide in new multi-family home construction. Sales of single-family homes were a bright spot, rising 2.7% to a three-month high, though that hopeful note was tempered by an 8.8% drop in new application permits–an indicator of future new home building.

Existing home sales also suffered a month-over-month decline in March, falling 2.4%. Sales plummeted 22% from March 2022 levels as higher mortgage rates and tight inventories impacted affordability.

This Week: Key Economic Data

Tuesday: Consumer Confidence. New Home Sales.

Wednesday: Durable Goods Orders.

Thursday: Gross Domestic Product (GDP). Jobless Claims.

Friday: Personal Income and Outlays. Consumer Sentiment.

Source: Econoday, April 21, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Monday: The CocaCola Company (KO).

Tuesday: Microsoft Corporation (MSFT), General Electric Company (GE), Verizon Communications, Inc. (VZ), Visa, Inc. (V), Alphabet, Inc. (GOOGL), General Motors Company (GM), McDonald’s Corporation (MCD), Ameriprise Financial, Inc. (AMP), 3M Company (MMM), Texas Instruments, Inc. (TXN), United Parcel Service, Inc. (UPS), PepsiCo, Inc. (PEP), NextEra Energy, Inc. (NEE), Spotify Technology (SPOT), Kimberly-Clark Corporation (KMB).

Wednesday: The Boeing Company (BA), ServiceNow, Inc. (NOW), Thermo Fisher Scientific, Inc. (TMO), General Dynamics Corporation (GD), eBay, Inc. (EBAY), Boston Scientific Corporation (BSX), Norfolk Southern Corporation (NSC).

Thursday: Amazon.com, Inc. (AMZN), Intel Corporation (INTC), AbbVie, Inc. (ABBV), Mastercard, Inc. (MA), Bristol Myers Squibb Company (BMY), Caterpillar, Inc. (CAT), Merck & Co., Inc. (MRK), The Southern Company (SO), Eli Lilly and Company (LLY), Northrop Grumman Corporation (NOC), Comcast Corporation (CMCSA).

Friday: Exxon Mobil Corporation (XOM), Chevron Corporation (CVX), Charter Communications, Inc. (CHTR).

Source: Zacks, April 21, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.