The Weekly Update

Week of July 20th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stocks were mixed last week as investors reacted to positive economic data, progress on a COVID-19 vaccine, and the continued nationwide increase in COVID-19 cases.

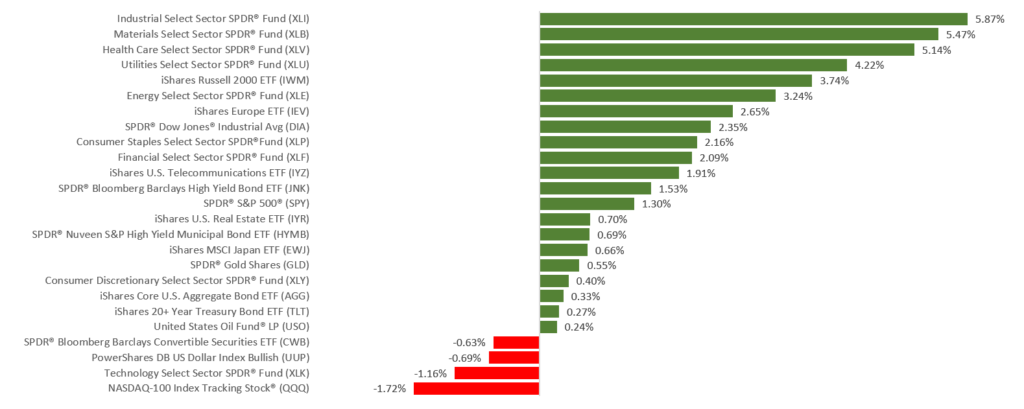

The Dow Jones Industrial Average gained 2.29%, while the Standard & Poor’s 500 rose by 1.25%. But the Nasdaq Composite Index dropped 1.08% for the week. The mega-cap technology companies saw some profit-taking last week, sending the Nasdaq Composite to its first loss in three weeks. The MSCI EAFE Index, which tracks developed stock markets overseas, ended 2.19% higher.

Stocks Find a Way Higher

After a Monday rally melted away on news that California was rolling back its reopening plans amid rising infections, a new earnings season began on a hopeful note. Stocks posted back-to-back daily gains on the strength of positive earnings surprises from a few money center banks and encouraging news about progress in the development of a COVID-19 vaccine.

Despite a strong retail sales number, new jobless claims and rising U.S.-China tensions reminded investors that global economic recovery remains fragile, leading stocks to pare some of the week’s earlier gains.

Earnings Season Begins

While investors long ago accepted the idea that this earnings season would be ugly, reflecting the impact of the economic shock due to COVID-19, it didn’t mean that there weren’t important insights to be gained from this quarter’s earnings reports.

Three money center banks last week kicked off the earnings season, reporting substantial declines in profits and an additional cumulative $28 billion set aside for loan-loss reserves.

Banks are an important economic bellwether since they touch every part of the U.S. economy. Although their earnings were significantly lower, they actually beat consensus Wall Street estimates, which encouraged investors and set the stage for stocks to move higher. The story on this quarter’s earnings season, however, is far from finished as investors await the stream of companies releasing their quarterly results in the days and weeks ahead.

THIS WEEK: KEY ECONOMIC DATA

Wednesday: Existing Home Sales.

Thursday: Index of Leading Economic Indicators. Jobless Claims.

Friday: New Home Sales.

Source: Econoday, July 17, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Tuesday: Lockheed Martin (LMT), Snap (SNAP), Coca Cola (KO), Texas Instruments (TXN), Capital One Financial (COF).

Wednesday: Microsoft (MSFT), Tesla (TSLA), United Airlines (UAL).

Thursday: AT&T (T), Intel (INTC), Union Pacific (UNP).

Friday: Verizon (VZ), American Express (AXP).

Source: Zacks, July 17, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.