The Weekly Update

Week of August 11th, 2025

By Christopher T. Much, CFP®, AIF®

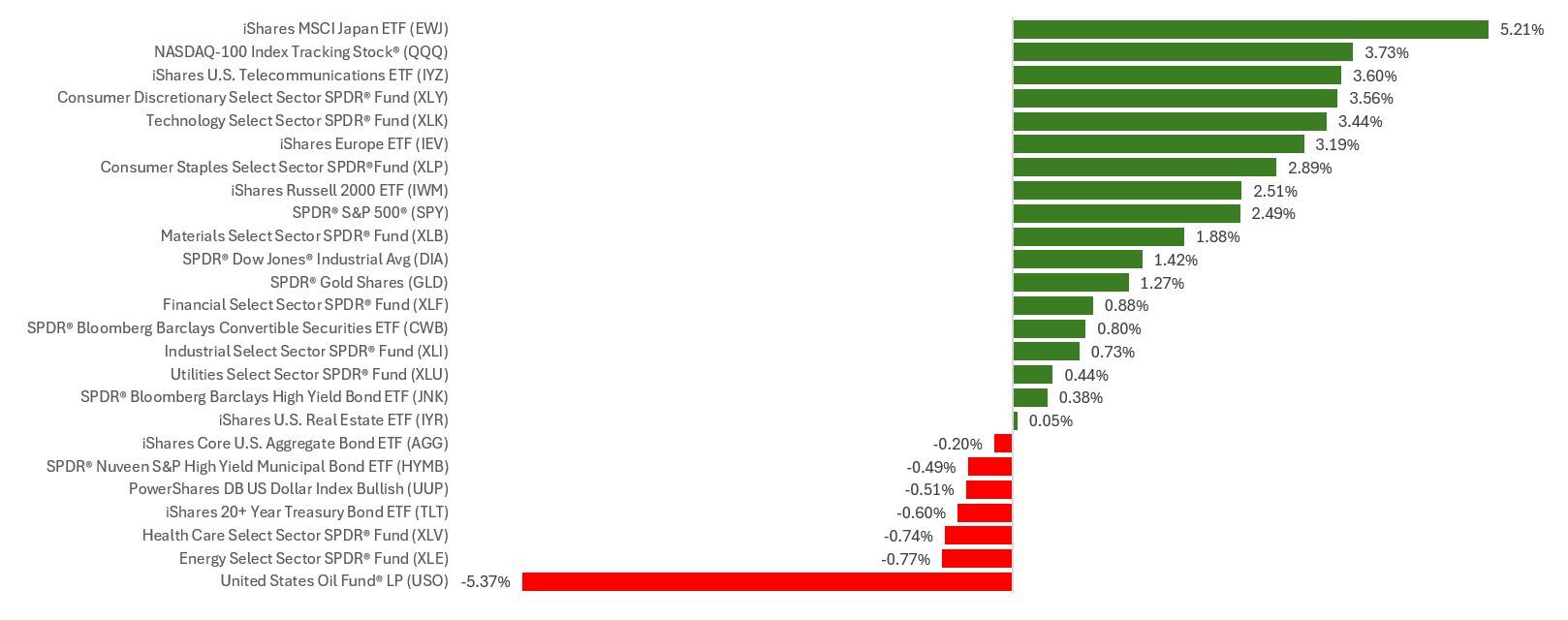

Stocks rebounded last week as investor optimism for a September rate adjustment and strong Q2 corporate results overcame the rollout of fresh tariffs.

The Standard & Poor’s 500 Index rose 2.43 percent, while the Nasdaq Composite Index gained 3.87 percent. The Dow Jones Industrial Average added 1.35 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, increased 2.77 percent.

Stocks Gyrate

Stocks pushed higher to start the week, with major averages gaining between 1.3 percent and 2 percent—their best day since May. Investors seemed more optimistic for a rate move after the weaker-than-expected July jobs report.

Stocks rose again midweek after the White House confirmed a mega-cap tech company would invest $500 billion more in domestic manufacturing. News of additional tariffs on India was greeted with a muted reaction from investors.

The updated tariffs previously announced by the White House went into effect on Thursday. Markets initially rose in early trading but then came under pressure as the day continued.6

But the S&P and Dow rose again on Friday, ending the week with solid gains. The tech-heavy Nasdaq ended the week with a record close.

Economy Watch

Services comprise 70 percent of the economy, so Wall Street closely monitors the Institute for Supply Management’s Services Index.

So, news on Tuesday that growth in services came below economists’ expectations was a bit of a concern. However, investors seemed to quickly look past the number and focus more on the 122 S&P 500 companies that reported earnings last week.

This Week: Key Economic Data

Tuesday: NFIB Small Business Optimism Index. Consumer Price Index (CPI). Federal Budget.

Wednesday: Atlanta Fed President Raphael Bostic speaks. Chicago Fed President Austan Goolsbee speaks.

Thursday: Weekly Jobless Claims. Producer Price Index (PPI). Fed Balance Sheet. Richmond Fed President Tom Barkin speaks.

Friday: Retail Sales. Industrial Production. Import & Export Prices. Business Inventories. Consumer Sentiment.

Source: Investor’s Business Daily – Econoday economic calendar; August 8, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: Cisco Systems, Inc. (CSCO)

Thursday: Applied Materials, Inc. (AMAT), Deere & Company (DE), NetEase, Inc. (NTES)

Source: Zacks, August 8, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.