The Weekly Update

Week of September 22nd, 2025

By Christopher T. Much, CFP®, AIF®

Stocks posted solid gains last week, propelled by the Fed’s decision to cut short-term interest rates.

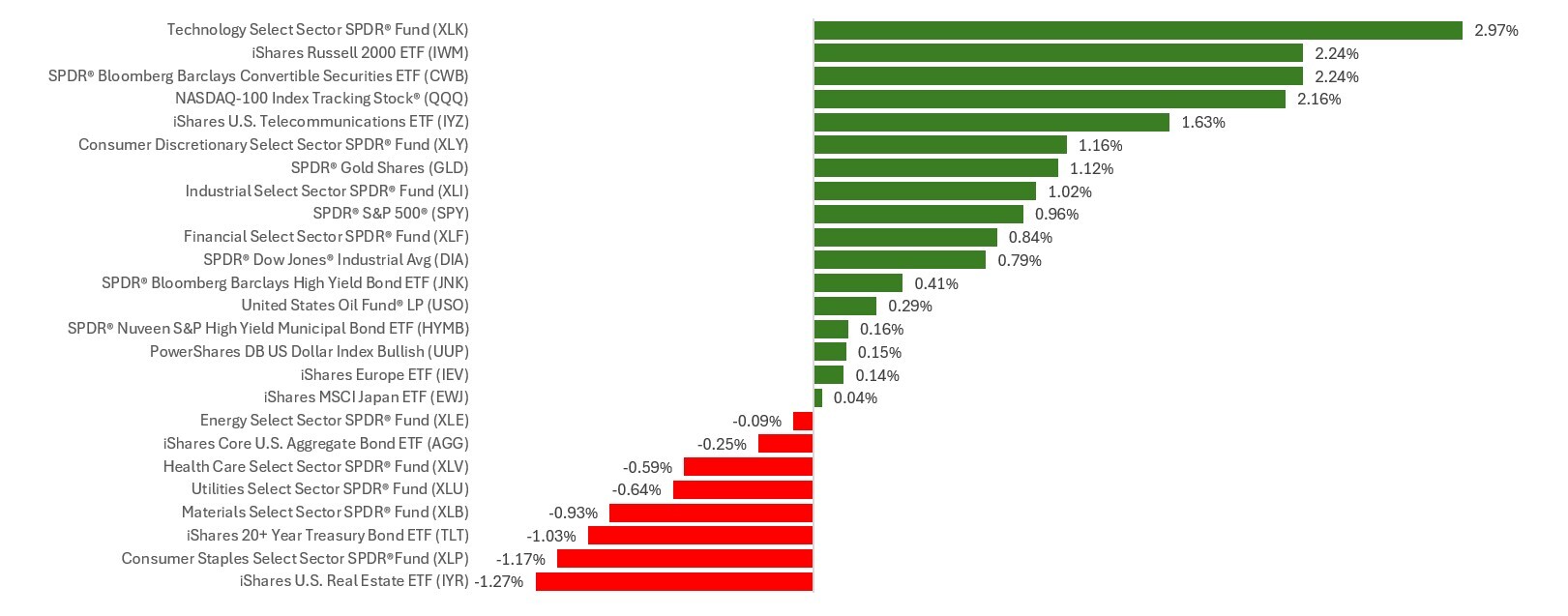

The Standard & Poor’s 500 Index rose 1.22 percent, while the Nasdaq Composite Index climbed 2.21 percent. The Dow Jones Industrial Average advanced 1.05 percent. By contrast, the MSCI EAFE Index, which tracks developed overseas stock markets, fell 0.27 percent.

Third Week of Gains for S&P, Nasdaq

Stocks advanced to start the week following the president’s positive comments on trade talks with China. The news helped push the S&P 500 to close above 6600 for the first time.

After the Fed announced on Wednesday that it was cutting short-term interest rates by a quarter percentage point, all three major averages fell before rising again in a choppy, mixed trading session.

After digesting the Fed decision, all three major averages posted solid gains on Thursday, paced by tech names. But small caps stole the day’s headlines, with the Russell 2000 Index gaining more than 2 percent and hitting an intraday record high. Smaller companies tend to disproportionately benefit when the Fed lowers interest rates, given their greater reliance on outside funding than larger companies.

The post-cut momentum continued into Friday; this was the second consecutive week of gains for the Dow Industrials, and the third straight week for the Nasdaq and S&P 500.

Following the Fed

The Federal Reserve decision brought the Federal Funds Rate down to a 4-4.25 percent target range—its lowest level in three years.

While widely anticipated, the real news about the cut was in the finer points made by Fed Chair Jerome Powell in the post-meeting press conference. He said the move was essentially a “risk management” cut. This concept confused investors a bit, resulting in scattered markets.

Powell also said two more rate adjustments are “penciled in” for this year. He suggested another rate change could occur in 2026, followed by another in 2027.

This Week: Key Economic Data

Monday: Fed Officials speak: John Williams (New York Fed President), Alberto Musalem (St. Louis Fed President), Stephen Miran (Fed governor), Beth Hammack (Cleveland Fed President), and Tom Barkin (Richmond Fed President).

Tuesday: PMI Composite. Fed Officials speak: Michelle Bowman (Vice Chair for Supervision), Raphael Bostic (Atlanta Fed President), and Jerome Powell (Fed Chair) speak.

Wednesday: New Home Sales. San Francisco Fed President Mary Daly speaks.

Thursday: Fed Officials speak: Austan Goolsbee (Chicago Fed President), John Williams, Michelle Bowman, Michael Barr (Fed governor), Lorie Logan (Dallas Fed President), and Mary Daly. Gross Domestic Product (GDP)—third estimate. Durable Goods. Weekly Jobless Claims. Trade Balance in Goods. Fed Balance Sheet. Retail & Wholesale Inventories. Existing Home Sales.

Friday: Personal Consumption and Expenditures (PCE) Index. Consumer Sentiment. Tom Barkin and Michelle Bowman speak.

Source: Investor’s Business Daily – Econoday economic calendar; September 19, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Micron Technology, Inc. (MU), AutoZone, Inc. (AZO)

Wednesday: Cintas Corporation (CTAS)

Thursday: Costco Wholesale Corporation (COST)

Source: Zacks, September 19, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.