The Weekly Update

Week of September 15th, 2025

By Christopher T. Much, CFP®, AIF®

Stocks posted a solid gain last week, riding a rally in megacap tech stocks while overcoming interest rate anxiety, a downward revision to jobs data, and mixed inflation reports.

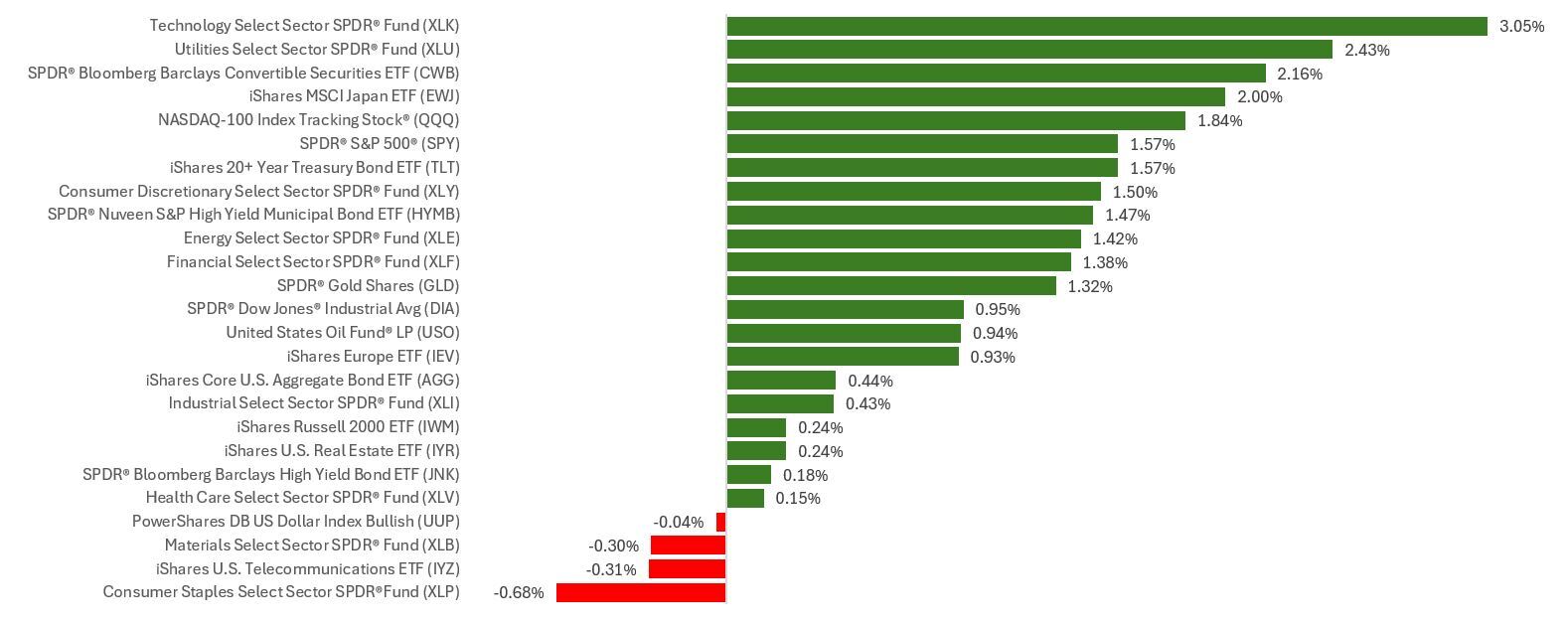

The Standard & Poor’s 500 Index rose 1.59 percent, while the Nasdaq Composite Index climbed 2.03 percent. The Dow Jones Industrial Average added 0.95 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, gained 1.18 percent.

Stocks At New Highs

Stocks rose to start the week on renewed AI enthusiasm, with the Nasdaq hitting a new record intraday high. Stocks continued to push ahead on Tuesday despite fresh data showing large downward revisions to job creation for the 12 months through March.

The rally continued midweek after an unexpected drop in wholesale inflation appeared to boost investors’ hopes for Fed rate moves before the year’s end.

Investors cheered Thursday’s consumer inflation report, anticipating that the reading wouldn’t be enough to derail a Fed rate move this month. The S&P and Nasdaq posted record intraday highs and closes three days in a row, while the Dow Industrials cracked 46,000 for the first time.

The Nasdaq hit a new record close on Friday, while the S&P 500 flattened out and the Dow posted a modest loss on the week’s last day of trading.

Fed Meets After Mixed Inflation Reports

Wednesday’s Producer Price Index (PPI) report showed wholesale prices fell 0.1 percent in August after a 0.7 percent increase in July. Then, on Thursday, fresh Consumer Price Index (CPI) data showed that retail prices rose a hotter-than-expected 0.4 percent in August—faster than July’s 0.3 percent gain.

All eyes will be on Fed Chair Powell this week. He is expected to outline his plan to adjust rates at the Fed’s scheduled two-day meeting, which ends on Wednesday, September 17. Investors will be looking for insights about how he plans to guide the economy through this period of sluggish job growth and stubborn consumer inflation.

This Week: Key Economic Data

Tuesday: Retail Sales. Import Price Index. Industrial Production. Business Inventories. Home Builder Confidence Index.

Wednesday: Housing Starts. Building Permits. Federal Reserve Interest Rate Decision. Fed Chair Powell Press Conference.

Thursday: Weekly Jobless Claims. Leading Economic Indicators.

Source: Investor’s Business Daily – Econoday economic calendar; September 12, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: General Mills, Inc. (GIS)

Thursday: FedEx Corporation (FDX)

Source: Zacks, September 12, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.