The Weekly Update

Week of August 28th, 2023

By Christopher T. Much, CFP®, AIF®

Stocks fluctuated last week, jostled by fitful bond yields and headline news, before ending strongly following Fed Chair Powell’s comments on the monetary outlook.

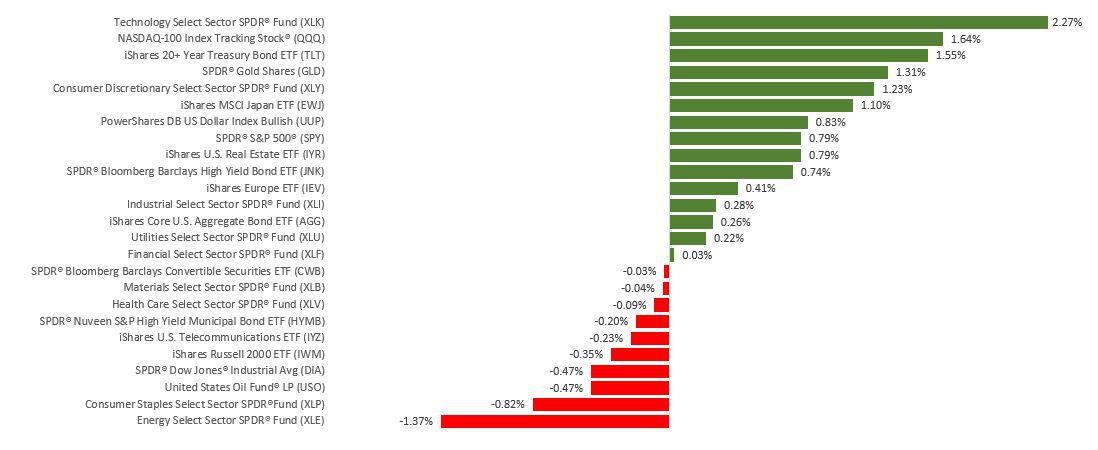

The Dow Jones Industrial Average slipped 0.45%, while the Standard & Poor’s 500 gained 0.82%. The Nasdaq Composite index rose 2.26% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, added 0.78%.

Stocks Manage Gains

Stock rallied on Monday on upbeat sentiment over the earnings release from a mega-cap semiconductor company scheduled for mid-week, only to see that momentum fizzle the following day on weak retail earnings and a credit downgrade of a handful of banks.

Stocks resumed their rally on weak economic data, which fueled hopes for future Fed dovishness. They also rose on expectations that earnings from a leading AI chipmaker would validate the AI narrative that propelled markets in the second quarter. Despite a blowout earnings report, stocks turned lower as investor attention quickly switched to Fed Chair Powell’s presentation scheduled for Friday.

After some initial jitteriness, Investors responded well to Powell’s comments, posting gains to close the week.

Powell Stands Firm

Powell spoke on Friday at the Fed’s annual economic symposium in Jackson Hole, asserting that, despite considerable progress, inflation remained too high and additional rate hikes may be in the offing. He acknowledged that previous rate increases had not yet thoroughly worked their way through the system, so caution about further hikes was needed.

Investors reacted to Powell’s comments far better than in August 2022, when a hawkish presentation sent stocks lower. Powell also addressed a growing feeling among investors that the Fed may eventually raise its inflation target to 2.5-3.0%. Powell rejected this idea unambiguously, stating that the two percent target would remain the Fed’s inflation goal.

This Week: Key Economic Data

Tuesday: Consumer Confidence. Job Openings and Turnover Survey (JOLTS).

Wednesday: Automated Data Processing (ADP) Employment Report. Gross Domestic Product (GDP).

Thursday: Personal Income and Outlays. Jobless Claims.

Friday: Employment Situation. Institute for Supply Management (ISM) Manufacturing Index.

Source: Econoday, August 25, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Hewlett Packard Enterprise Company (HPE), HP, Inc. (HPQ)

Wednesday: Salesforce, Inc. (CRM), Veeva Systems, Inc. (VEEV), CrowdStrike (CRWD).

Thursday: lululemon athletica, inc. (LULU), Broadcom, Inc. (AVGO), Dollar General Corporation (DG), Dell Technologies, Inc. (DELL), VMware, Inc. (VMW)

Source: Zacks, August 25, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.