The Weekly Update

Week of February 20, 2018

By Christopher T. Much, CFP®, AIF®

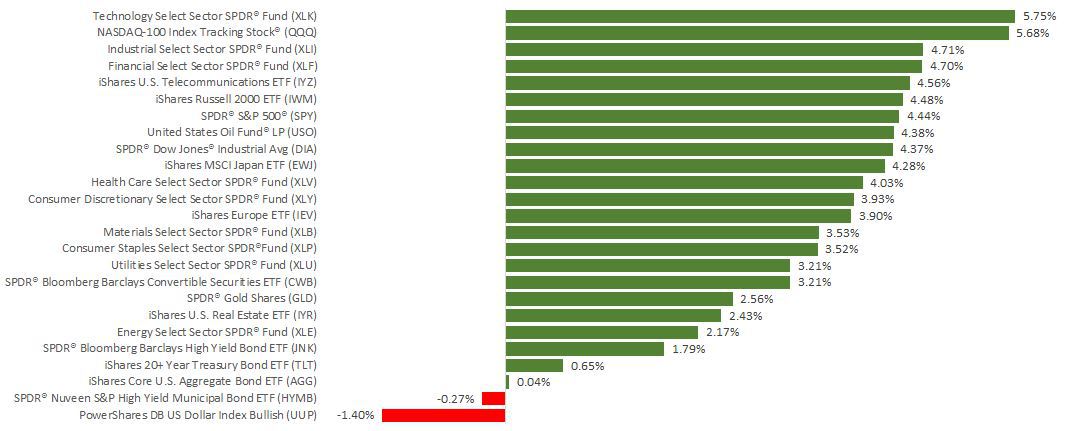

Markets rebounded last week, posting sizable gains and moving back into positive territory for the year. All three domestic indexes experienced their largest weekly growth in years, despite losing some ground on Friday after news of additional indictments in the Russia investigation.

By markets’ close on February 16, the S&P 500 added 4.30%, the Dow was up 4.25%, and the NASDAQ increased 5.31%. International stocks in the MSCI EAFE also gained 4.18% for the week.

This performance, however, did not come from simple, straightforward increases. Instead, the volatility from recent weeks continued. In fact, the S&P 500 lost or gained at least 1% on 8 of the past 10 trading days. The index only experienced that movement level 8 times throughout 2017.

Key Economic Findings

We received a wealth of data last week, and the readings helped deepen our understanding of the economy. The reports showed some mixed results, but much of the information continues to indicate that the economy is on solid ground.

January Highlights

- Housing starts jumped 9.7%, beating expectations and reaching the second fastest rate since the recession. Even with mortgage rates increasing and tax reform affecting some buyers’ mortgage interest deductions, the data shows positive news for future homebuilding as well.

- Consumer price index increased 0.5%, rising 2.1% in the past year. This reading indicates that prices are continuing to rise faster than the Federal Reserve’s target rate.

- Retail sales fell, dropping 0.3% in part due to slow motor vehicle sales. In addition, negative updates to December’s readings could affect fourth quarter Gross Domestic Product results.

February Highlights

- Consumer sentiment beat expectations, coming in at 99.9 – its second highest reading in 14 years. The movement came as tax-cut optimism outweighed stock-market concerns.

The Takeaway

Many reports show that the economy is strong, so watching for inflation will remain important as the markets keep moving. The combination of growing inflation and a strong labor market means the Fed is still likely to hike rates 3 times this year, with a fourth increase very possible.

Looking ahead, volatility may continue, so keep this on your radar. Investors caught between conflicting concerns about missing the bull market and losing money may contribute to ongoing uncertainty. Remember, stock fluctuations are normal. We are here to help you understand what’s happening in the markets and how to position yourself for the financial life you desire.

ECONOMIC CALENDAR:

Monday: U.S. Markets Closed for Presidents’ Day

Wednesday: Existing Home Sales

Thursday: Jobless Claims