The Weekly Update

Week of September 3, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Fears of an impasse in the U.S.-China trade dispute lessened last week. While additional U.S. tariffs on Chinese imports were scheduled to take effect on September 1, China’s government communicated that it would refrain from taking retaliatory measures for the moment.

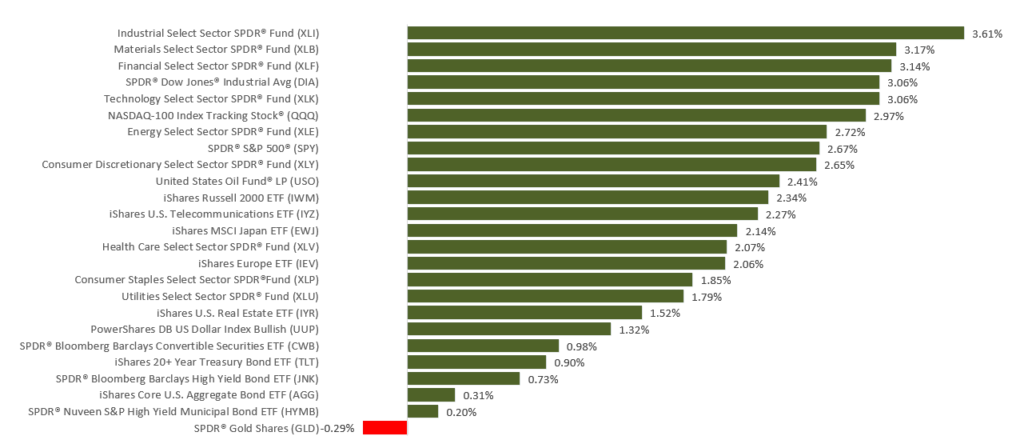

U.S. stock benchmarks advanced during the week. The S&P 500 rose 2.79% across five trading days, and the Nasdaq Composite and Dow Jones Industrial Average respectively gained 2.72% and 3.02%. The MSCI EAFE international index added just 0.25%.

Positive News in the Trade Dispute

Thursday, a spokesman for China’s commerce ministry said that negotiations could resume this month, and that discussions need to focus on “removing the new tariffs to prevent escalation.”

In addition, officials in Beijing indicated they would hold off on responding to the U.S. tariff hikes announced Friday by the White House.

Mixed Consumer Confidence Signals

The Conference Board’s monthly consumer confidence index was at 135.1 in August. Analysts polled by Reuters had projected a reading of 129.5. Consumers’ view of the present economic situation was the best since November 2000.

On the other hand, the University of Michigan’s monthly consumer sentiment index (based on a different collection of survey data) dropped 8.6 points during August to 89.8; that was its biggest monthly descent in nearly seven years. ,

What’s Next

After a pause for the Labor Day holiday, U.S. financial markets have an abbreviated trading week. The August jobs report may influence Friday’s Wall Street session, and any news pertaining to U.S.-China trade talks could also influence the markets.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: The Institute for Supply Management releases its August purchasing managers index (PMI) for the factory sector, assessing U.S. manufacturing activity.

Thursday: ISM presents its August PMI for the service sector, and payroll giant ADP publishes its latest private-sector employment snapshot.

Friday: The Department of Labor offers its August employment report.

Source: Econoday / MarketWatch Calendar, August 30, 2019

The Econoday and MarketWatch economic calendars list upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Wednesday: Palo Alto Networks (PANW), Slack Technologies (WORK)

Thursday: Lululemon Athletica (LULU)

Source: Zacks, August 30, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.