The Weekly Update

Week of May 1st, 2023

By Christopher T. Much, CFP®, AIF®

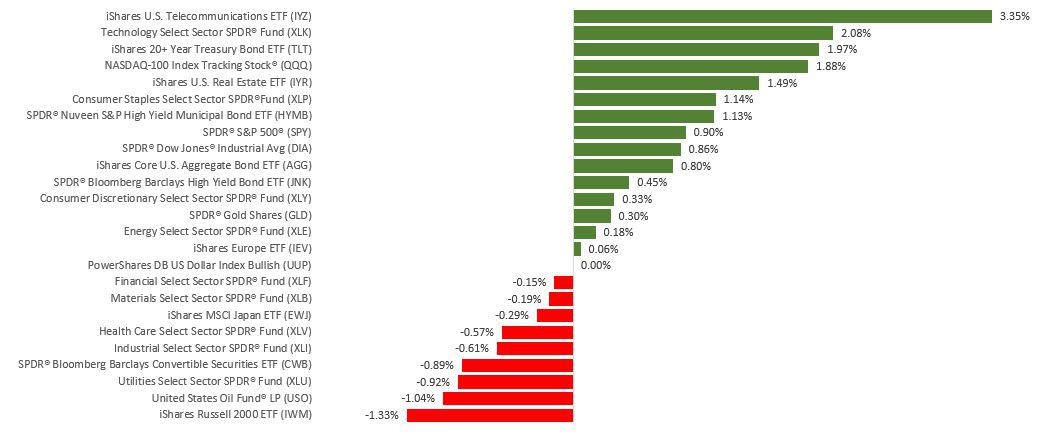

Strong earnings from several mega-cap technology companies offset renewed regional banking jitters and weak economic data, leaving stocks higher for the week.

The Dow Jones Industrial Average gained 0.86%, while the Standard & Poor’s 500 added 0.87%. The Nasdaq Composite index rose 1.28% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, lost 0.60%.

Earnings Drive Rebound

It was a very busy week of earnings reports, but none more important than those from the Big Tech names. After two days of sharp losses on revived regional banking fears and otherwise lackluster earnings results, stocks rallied powerfully on a succession of positive earnings surprises from several mega-cap companies.

Also aiding the sentiment was last week’s first quarter Gross Domestic Product (GDP) report. Though the report showed muted economic growth that fell short of expectations, investors were encouraged by strong consumer spending.

Slowing Growth

In a sign that higher rates are slowing economic growth, first-quarter GDP slowed to a 1.1% annualized growth rate as healthy consumer spending helped offset a decline in business investment and a slowdown in nonresidential investment.

Economists had expected first-quarter GDP growth to come in at 2%. The business inventory investment slowdown reduced the headline GDP number by 2.26%. The initial estimate of GDP also reported some disappointing inflation news as the quarter-over-quarter Personal Consumption Expenditures Price Index, the Fed’s preferred inflation measure, rose 4.2%, which was higher than the 3.7% forecast.

This Week: Key Economic Data

Monday: Institute for Supply Management (ISM) Manufacturing Index.

Tuesday: Factory Orders. Job Openings and Turnover Survey (JOLTS).

Wednesday: FOMC Announcement. Institute for Supply Management (ISM) Services Index.

Thursday: Jobless Claims.

Friday: Employment Situation.

Source: Econoday, April 28, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Monday: Stryker Corporation (SYK), ON Semiconductor Corporation (ON).

Tuesday: Advanced Micro Devices, Inc. (AMD), Ford Motor Company (F), Pfizer, Inc. (PFE), Starbucks Corporation (SBUX), Marathon Petroleum (MPC).

Wednesday: CVS Health Corporation (CVS), Qualcomm, Inc. (QCOM), Albemarle Corporation (ALB), Barrick Gold Corporation (GOLD).

Thursday: Apple, Inc. (AAPL), Block, Inc. (SQ), Shopify, Inc. (SHOP), ConocoPhillips (COP), Booking Holdings, Inc. (BKNG), Regeneron Pharmaceuticals, Inc. (REGN).

Friday: Cigna Group (CI), EOG Resources, Inc. (EOG), Dominion Energy, Inc. (D).

Source: Zacks, April 28, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.