The Weekly Update

Week of October 9th, 2023

By Christopher T. Much, CFP®, AIF®

A Friday rally overcame a shaky week, sending stocks mostly higher.

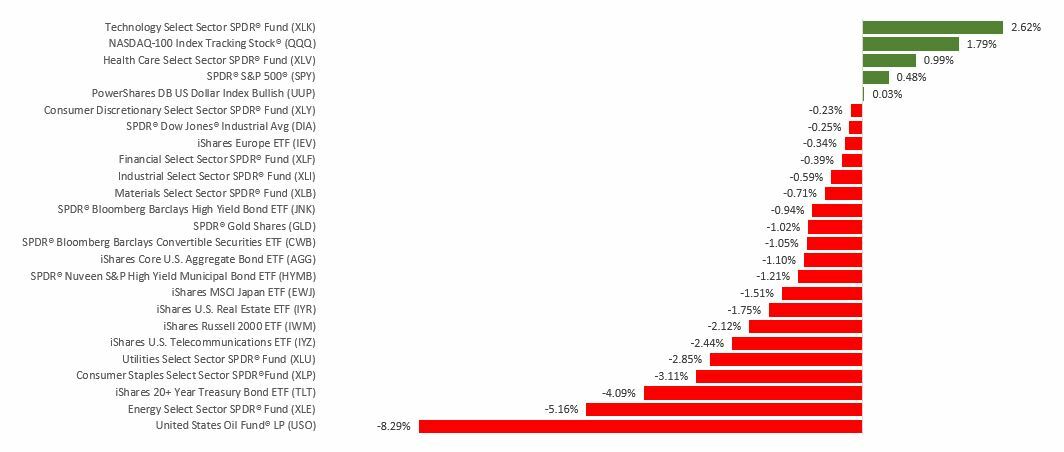

The Dow Jones Industrial Average slipped 0.30% for the week. Meanwhile, the Standard & Poor’s 500 gained 0.48%, and the Nasdaq Composite index added 1.60% for the five trading days. The MSCI EAFE index, which tracks developed overseas stock markets, fell 2.37%.

Friday Rally

Stocks rallied on Friday after a stronger employment report than Wall Street expected. The headline indicating an increase in September payrolls initially generated fears of further Fed rate hikes, leading to a spike in bond yields and steep early morning losses. A yield retreat may have triggered the turnaround as investors focused more on the month’s moderate wage growth.

Stocks were shaky for much of last week on rising bond yields. When Treasury yields hit their highest level since 2007 on Tuesday, stock prices dropped, leaving the Dow Industrials in negative territory for the year. The catalyst for the day’s spike in interest rates was a surprisingly strong JOLTS (Job Openings and Labor Turnover Survey) showing nearly one million more open jobs than investors had expected.

All About Jobs

The labor market remains resilient. August JOLTS showed job openings exceeded 9.6 million, above the consensus estimate of 8.8 million. A weak Automated Data Processing (ADP) private payroll job growth (released Wednesday) that showed 89,000 new private sector jobs appeared to be an outlier compared to the other reports.

Friday’s monthly employment report showed a robust gain of 336,000 new jobs, nearly double the consensus forecast of 170,000. At the same time, the previous two months saw significant upward revisions of 119,000 (combined) from initial reports. Wage gains rose modestly, coming in below expectations and striking a hopeful note on inflation.

This Week: Key Economic Data

Wednesday: Producer Price Index (PPI). Federal Open Market Committee (FOMC) Minutes.

Thursday: Consumer Price Index (CPI). Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, October 6, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Thursday: Delta Air Lines, Inc. (DAL)

Friday: JPMorgan Chase & Co. (JPM), UnitedHealth Group, Inc. (UNH), Citigroup, Inc. (C), Wells Fargo & Co. (WFC), The PNC Financial Services Group, Inc. (PNC), BlackRock, Inc. (BLK)

Source: Zacks, October 6, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.