The Weekly Update

Week of August 7th, 2023

By Christopher T. Much, CFP®, AIF®

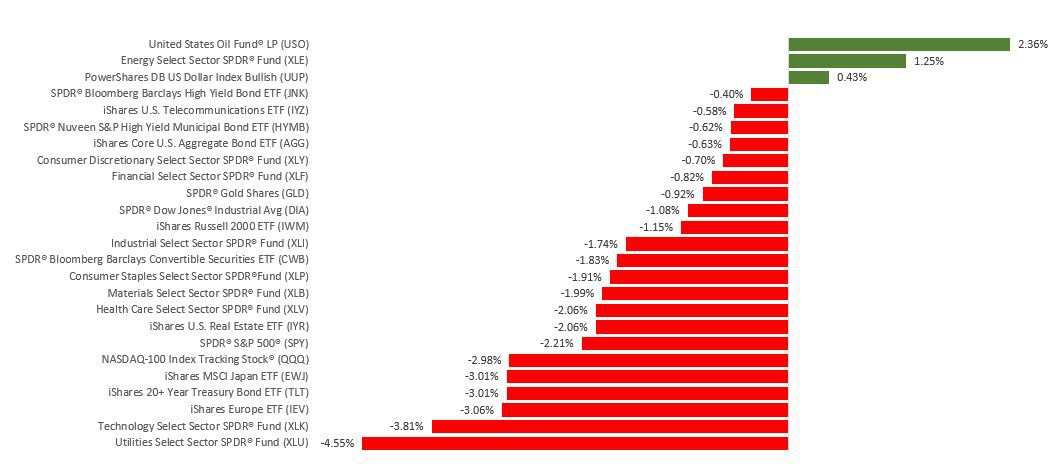

Stocks retreated last week as bond yields increased following the Treasury’s announcement indicating “a larger-than-expected funding need” and a downgrade in the federal government’s debt rating.

The Dow Jones Industrial Average dropped 1.11%, while the Standard & Poor’s 500 shed 2.27%. The Nasdaq Composite index lost 2.85% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, tumbled 3.27%

Stocks Struggle

Stocks struggled as investor sentiment turned cautious amid rising bond yields. Markets were rattled initially by news that the Treasury raised its borrowing requirement for the third quarter by more than a quarter of a trillion dollars and on news that the Bank of Japan announced it would allow bond yields to rise after years of capping them.

Rising yields continued to pressure stocks in the wake of a surprise rating downgrade of U.S. government debt by a major credit rating agency due to its belief in expected fiscal deterioration over the next three years.

Stocks rebounded Friday morning, rising on modest employment data only to reverse and add to the week’s losses.

Mixed Signals From The Labor Market

Fresh employment data last week gave some conflicting signals about the labor market. A new JOLTS (Job Openings and Turnover Survey) report showed a small decline in job openings and layoffs in June, leaving 1.6 job openings for each available worker.4

Automated Data Processing’s (ADP) employment report reflected strong private sector hiring with a 324,000 increase in jobs, exceeding the consensus forecast of a 175,000 gain.

This Week: Key Economic Data

Thursday: Consumer Price Index (CPI). Jobless Claims

Friday: Producer Price Index (PPI). Consumer Sentiment

Source: Econoday, August 4, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Monday: Skyworks Solutions, Inc. (SWKS)

Tuesday: Eli Lilly and Company (LLY), Duke Energy Corporation (DUK), United Parcel Service, Inc. (UPS), ONEOK, Inc. (OKE)

Wednesday: The Walt Disney Company (DIS)

Source: Zacks, August 4, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.