The Weekly Update

Week of February 11, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Major U.S. stock benchmarks eked out slight gains last week, with corporate profit reports and news about U.S.-China trade negotiations vying for investor attention over five trading sessions.

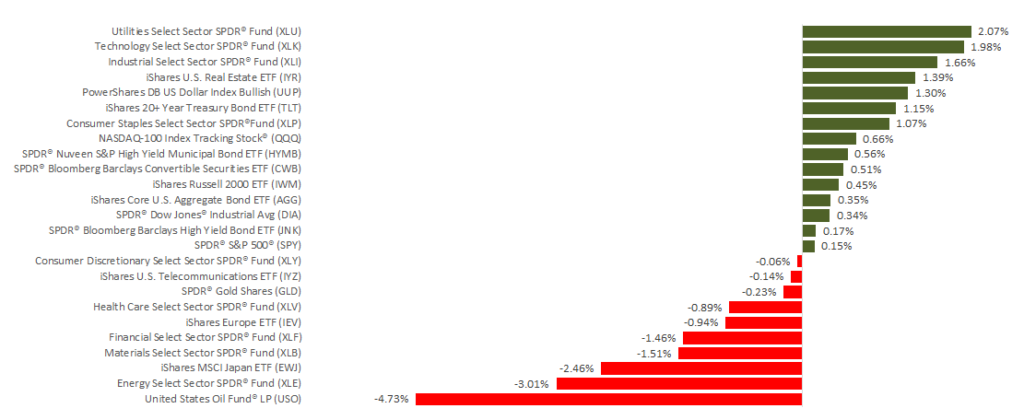

The big three ended the week little changed from where they settled the previous Friday. The Dow Jones Industrials rose 0.17% percent, while the S&P 500 Index gained 0.05% percent. The NASDAQ Composite ended the week up 0.47%. Looking at international stocks, the MSCI EAFE index retreated 0.47%.

Earnings Scorecard

As of last Friday, 66% of all S&P 500 companies had reported fourth-quarter earnings. So far, 71% of these firms have announced earnings exceeding estimates, and 62% have seen revenues top projections

Halfway through earnings season, 2019 future guidance has been a mixed bag for S&P 500 companies. For Wall Street, future earnings can be just as important as current earnings. We keep a close eye on both.

Tariff Tensions

March 1 is the 90-day deadline set by President Trump for a trade deal with China. If no agreement is reached, the U.S. may consider a new round of tariffs. On Thursday, news that President Trump and Chinese President Xi may not meet before the March 1 deadline added to the market volatility.

The decision by the U.S. on new tariffs may hinge on how much progress has been made toward a new agreement. We don’t expect that to become clear until the deadline nears.

State of the Service Sector

Many indicators help economists take the pulse of the overall economy. The Institute for Supply Management keeps a critical, but not widely followed, index, which helps gauge the health of the service sector.

The January reading on this index came in at 56.7. Any reading above 50 shows that the service industry is seeing solid growth.

Final Thought

Over the next several weeks, we’re expecting more volatility as the markets digest economic news, a new wave of corporate earnings, and twists and turns on the geopolitical front. We will be watching to see if anything changes our short-term and long-term view. If you have any questions, don’t hesitate to contact us.

ECONOMIC CALENDAR:

Wednesday: January’s Consumer Price Index, which measures monthly and yearly inflation.

Thursday: December retail sales figures (a delayed release due to the government shutdown).

Friday: January’s preliminary University of Michigan consumer sentiment index, a gauge of consumer confidence levels.