The Weekly Update

Week of January 28, 2019

By Christopher T. Much, CFP®, AIF®

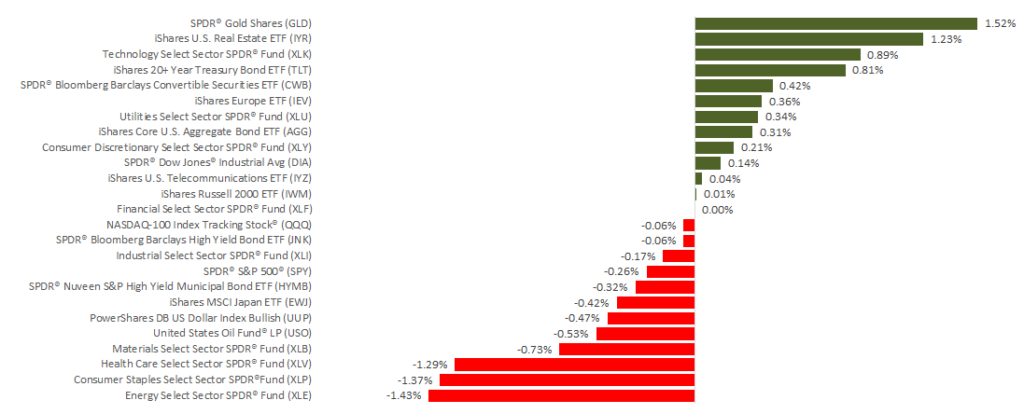

For the first time in months, U.S. markets experienced little movement last week. The Dow and NASDAQ did have their 5th week of gains in a row, but their increases were small: 0.12% and 0.11%, respectively. Meanwhile, the S&P 500 broke its 4-week winning streak with a 0.22% loss. Internationally, the MSCI EAFE also posted modest returns, gaining 0.47% for the week.

What topics were on investors’ minds?

Despite the relative lack of market drama last week, investors still had plenty to consider. For example, the following details emerged:

- Conflicting messages came out on trade tension with China.

- The International Monetary Fund (IMF) downgraded its forecast for global growth.

- Corporate earnings season continued.

In addition, the longest Federal government shutdown in history ended. After 35 days, the House and Senate voted unanimously to reopen the partially closed government. President Trump signed the bill, which includes funding through February 15.

This week could provide far more action in the markets when a number of key details emerge.

What’s ahead this week?

These last days of January provide several noteworthy updates, including:

- Federal Reserve Meeting: Most people expect that the Fed will not increase rates this week. However, many investors will be studying how the central bank describes its plans for 2019 and assessment of the economy’s strength.

- Corporate Earnings: This week, 126 S&P 500 companies will release their earnings data. Major reports could help provide insight into everything from U.S. consumers to global industry.

- China Negotiations: Chinese Vice Premier Liu and his delegation are coming to Washington to conduct additional trade discussions. As we have discussed for months, the ongoing tension is affecting markets as investors look for clarity on what may lie ahead.

One data point we may not receive this week is the initial reading of 4th quarter 2018 Gross Domestic Product. This report is one of many affected by the Federal government shutdown. Although the government has reopened, we have yet to receive the latest data on retail sales, new home sales, durable goods orders, and more.

As the week unfolds, we will analyze all of the information that does come out—and continue to look for ways to pursue our clients’ long-term goals in the current economic environment. If you have any questions about how these details affect your financial life, we’re here to talk.

ECONOMIC CALENDAR*:

Tuesday: Consumer Confidence

Wednesday: ADP Employment Report, GDP

Thursday: Jobless Claims

Friday: Motor Vehicle Sales, PMI Manufacturing Index, ISM Mfg Index, Construction Spending, Consumer Sentiment

*The Federal government shutdown may delay some data releases.