The Weekly Update

Week of September 25, 2017

By Christopher T. Much, CFP®, AIF®

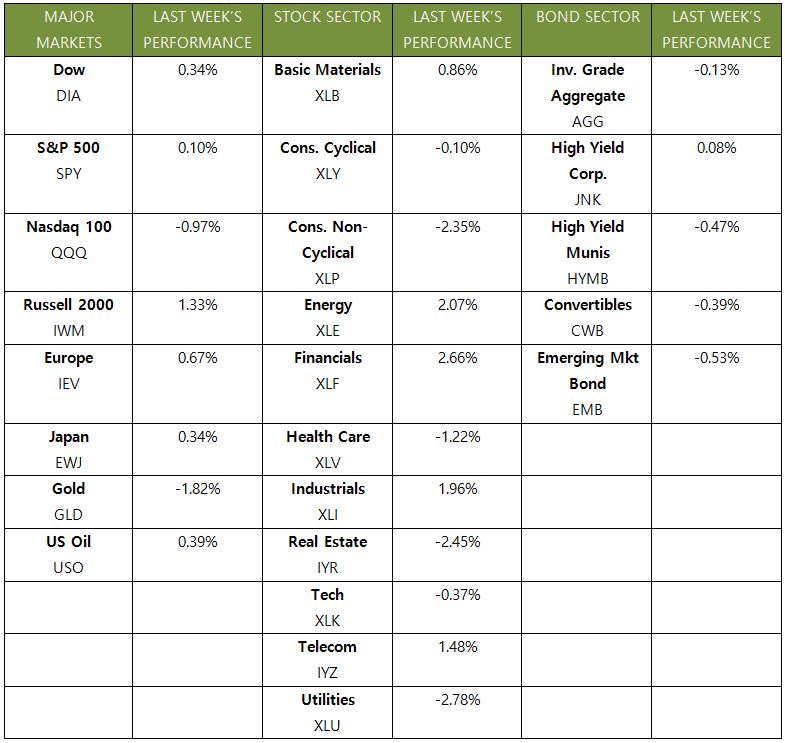

Domestic indexes were mixed last week, as the Dow gained 0.36%, the S&P 500 eked out a 0.08% increase, and the NASDAQ lost 0.33%. International stocks in the MSCI EAFE added a solid 0.68%.

Three stories that have dominated conversations and driven investor attention in 2017 continued last week:

- Healthcare policy: The Senate’s continuing discussion of healthcare reform impacted stock performance in connected industries.

- Tension with North Korea: The markets responded quietly to continuing conflict between President Trump and Kim Jong Un, although some investments saw a bump later in the week.

- Interest rate updates: While the Fed chose not to raise interest rates in its most recent meeting, it indicated that a December hike is definitely still on the table.

When announcing its latest interest rate perspectives, the Federal Reserve also indicated that it would begin to reduce its balance sheet next month.

But, what does that really mean—and why does the Fed have a $4.2 trillion balance sheet, anyway?

A Look Back on Quantitative Easing

During the financial crisis and recession, the Fed took an unprecedented and controversial approach to stabilizing our economy and the world’s markets. By buying trillions of dollars of Treasury and mortgage bonds between 2008 and 2014, it aimed to encourage hiring, economic growth, and investing. This action is commonly known as Quantitative Easing (QE).

Through the three rounds of QE, the Fed added trillions of dollars of new money to the financial markets. Since QE first began almost a decade ago, we have seen unemployment reach a 16-year low and the S&P 500 more than triple from its bottom in 2009. Although economic growth is still slower than before the recession, the Fed believes the economy is now strong enough to handle more normal monetary policy.

In October, the Fed will start the gradual process of lowering its balance sheet—currently equal to about a quarter of Gross Domestic Product (GDP). Thus far, investors have had a mild response to this plan. As the Fed begins slowly allowing billions of dollars of bonds to roll off, we will closely monitor the economic impact.

We know that monetary policy can seem like an incredibly complex topic—and, frankly, it is. However, we think you deserve to understand the large forces at play in your financial life. If you have any questions about the Fed’s latest announcement, or any other financial details, we’re always here to talk.

ECONOMIC CALENDAR

Tuesday: New Home Sales, Consumer Confidence

Wednesday: Durable Goods Orders

Thursday: GDP

Friday: Personal Income and Outlays, Consumer Sentiment