The Weekly Update

Week of November 20, 2017

By Christopher Much, CFP®, AIF®

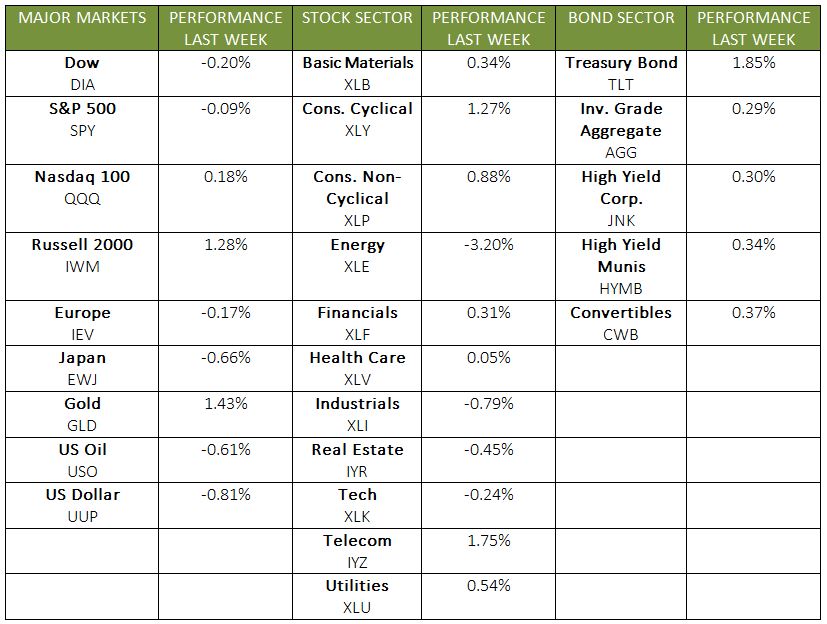

Domestic stock performance varied last week, with the S&P 500 and Dow losing ground for the 2nd straight week, while the NASDAQ posted gains. By Friday, the S&P 500 had dropped 0.13%, the Dow gave back 0.27%, and the NASDAQ gained 0.47%. International stocks in the MSCI EAFE stumbled, dropping 0.67%.

Tax reform remained a key focus in the markets, as investors questioned whether changes will happen by the end of 2017. The markets have largely priced in expectations that tax reform will move forward, a belief that has helped drive this year’s record prices. Treasury Secretary Mnuchin expects the President to receive a bill by Christmas, but despite his update, concerns about meeting this deadline remain. This uncertainty—combined with questions about differences between the House and Senate plans—has contributed to the market volatility we’ve seen in recent weeks.

While tax reform may be impacting stocks right now, going beyond the geopolitical debate reveals various positive economic updates.

An Overview of Last Week’s Economic Insight

From housing to industrial production, last week gave us a variety of economic updates for October. Overall, the data indicates that the economy is on solid ground.

- Retail sales grew

Hurricanes are still affecting retail sales, but October’s reading shows decent performance—and analysts expect the holiday season to drive strong results through year’s end. - Consumer prices increased slightly

Inflation remains relatively low and slow, yet this month’s report shows it moving in the right direction toward the Fed’s goal of a 2% level. - Industrial production surged

A large jump in manufacturing helped drive industrial growth and indicates a strengthening sector—good news for our economy. - Housing starts beat expectations

The housing industry experienced strong growth in new permits, construction starts, and completed homes.

What Is Ahead

Tax reform will likely continue to be a hot topic in Washington and the markets. We will follow any changes or updates as they occur, and understanding the economy’s underlying strength will remain our key focus.

As a reminder, with Thanksgiving on Thursday, the markets will only be open for 4 days this week. During this season of gratefulness, we want to thank you for your ongoing trust and reinforce that we are always here to support you on your financial journey.

ECONOMIC CALENDAR

Tuesday: Existing Home Sales

Wednesday: Durable Goods Orders, Consumer Sentiment

Thursday: Markets Closed for Thanksgiving

Friday: PMI Composite Flash