The Weekly Update

Week of January 29, 2018

By Christopher T. Much, CFP®, AIF®

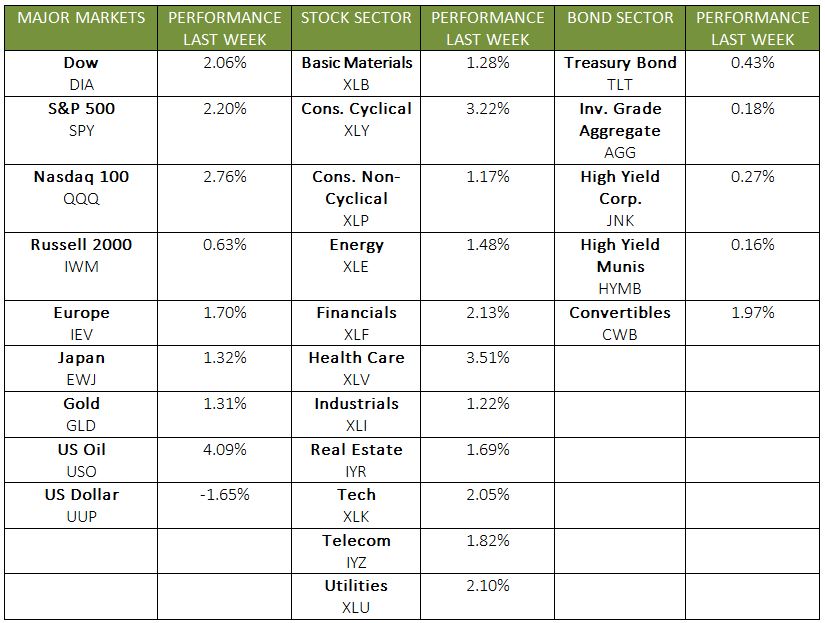

Stocks had an impressive week yet again, as each of the domestic indexes reached record highs and gained at least 2%. The S&P 500 added 2.23%, the Dow increased 2.09%, and the NASDAQ grew 2.31%. International stocks in the MSCI EAFE joined the growth, adding 1.49%.

On Monday, January 22, the government shutdown ended after 3 days, as House and Senate members reached an initial compromise. President Trump signed the measure on Monday evening, securing government funding until February 8.

With the funding discussion set aside for the next week or so, we believe 3 topics were of particular interest for the markets:

- Corporate earnings

- Global growth

- Gross domestic product (GDP) readings

1. Corporate Earnings

We are in the middle of the best corporate earnings season in 5 years. So far, 80% of S&P 500 companies that released 4th-quarter data have exceeded their earnings estimates—and 82% beat sales. In addition, the average earnings-per-share estimate for the 1st quarter of 2018 is also increasing. This data point has not gone up for 7 years.

2. Global Growth

Last week, many of the world’s economic leaders gathered in Davos, Switzerland, for the World Economic Forum. Talk of “increased global growth momentum” contributed to a mood that many people described as more positive than in many years. The International Monetary Fund (IMF) Managing Director, Christine Lagarde, described the current economic situation as a “sweet spot.” Many delegates echoed her enthusiasm, while others warned of becoming too elated.

During the meeting, the IMF released revised estimates for global growth, indicating that they expect the momentum to continue through at least 2019.

3. GDP Readings

We received the initial reading for 4th quarter GDP, which showed that the U.S. economy grew by 2.6% between October and December. This increase fell short of analysts’ expectations, but it still reveals healthy economic growth. In addition, when going beyond the headline, the data indicates that many key GDP contributors performed well.

In the 4th quarter, consumer spending, residential investment, and government purchases all helped to drive economic growth. Inventories and net exports pulled down the GDP increase. If you exclude these two contributors, the economy grew by 4.3%.

As we prepare for what 2018 has in store, we are happy that data continues to show a strengthening economy. However, we will work with the knowledge that risk exists in every market environment. Along the way, we are here to answer any questions and provide the insights you seek.

ECONOMIC CALENDAR:

Monday: Personal Income and Outlays

Tuesday: Consumer Confidence

Wednesday: ADP Employment Report, Employment Cost Index

Thursday: Motor Vehicle Sales, PMI Manufacturing Index, Construction Spending

Friday: Employment Situation, Consumer Sentiment, Factory Orders

.

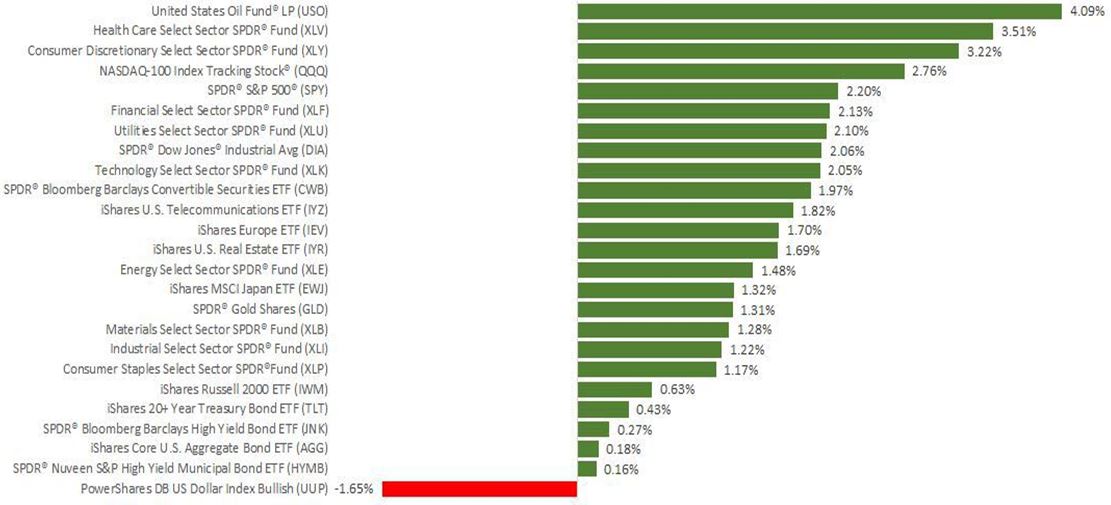

We are excited to introduce the new CTS Major Markets Performance graph. Look for this new format on a go forward basis.

.