The Weekly Update

Week of July 31st, 2023

By Christopher T. Much, CFP®, AIF®

A Friday surge pushed stocks solidly into positive territory last week, ignited by cooling in an inflation gauge closely tracked by the Federal Reserve.

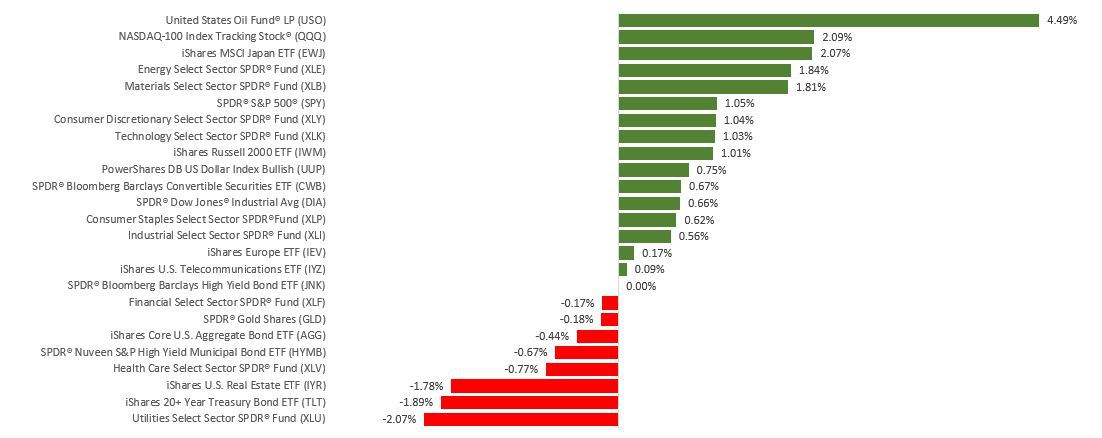

The Dow Jones Industrial Average advanced 0.66%, while the Standard & Poor’s 500 climbed 1.01%. The Nasdaq Composite index rose 2.02% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 0.74%.

Stocks Pop

Stocks were flat for much of last week amid a batch of new earnings, a 0.25% interest rate hike, and strong economic data. After beginning with gains, stocks lost momentum following the Fed’s expected rate-hike announcement on Wednesday. A bounce on Thursday sparked by a positive mega-cap tech company earnings reversed after bond yields increased.

Stocks recovered strongly Friday on the release of the personal consumption expenditures price index, which fell to its lowest level in two years.

Much of the market action was related to earnings results. With 44% of S&P 500 companies reporting, 78% have exceeded Wall Street forecasts.

Recession Deferred

Expectations of a recession were high coming into 2023. Last week may have erased this recession narrative overhang.

Second-quarter gross domestic product (GDP) data released last week was one big reason why. Economic activity expanded by 2.4%, which was above the forecast of two percent and represented an acceleration from its first quarter GDP of 2.0%. Consumer spending was a major driver of that expansion, rising 1.6%.

This Week: Key Economic Data

Tuesday: Institute for Supply Management (ISM) Manufacturing Index. Job Openings and Labor Turnover Survey (JOLTS).

Wednesday: Automated Data Processing (ADP) Employment Report.

Thursday: Jobless Claims. Institute for Supply Management (ISM) Services Index.

Friday: Employment Situation.

Source: Econoday, July 28, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Monday: Arista Networks, Inc. (ANET), ON Semiconductor Corporation (ON)

Tuesday: Advanced Micro Devices, Inc. (AMD), Pfizer, Inc. (PFE), Caterpillar, Inc. (CAT), Starbucks Corporation (SBUX), Merck & Co., Inc. (MRK), Prudential Financial, Inc. (PRU), Rockwell Automation, Inc. (ROK)

Wednesday: CVS Health Corporation (CVS), Qualcomm, Inc. (QCOM), PayPal Holdings, Inc. (PYPL), Shopify, Inc. (SHOP), Albemarle Corporation (ALB), Emerson Electric Co. (EMR), Humana, Inc. (HUM)

Thursday: Apple, Inc. (AAPL), Block, Inc. (SQ), Gilead Sciences, Inc. (GILD), Amgen, Inc. (AMGN), Cigna Group (CI), Occidental Petroleum Corporation (OXY), Fortinet, Inc. (FTNT), ConocoPhillips (COP), Booking Holdings, Inc. (BKNG), Regeneron Pharmaceuticals, Inc. (REGN)

Friday: EOG Resources, Inc. (EOG)

Source: Zacks, July 28, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.