The Weekly Update

Week of September 25th, 2023

By Christopher T. Much, CFP®, AIF®

Rising bond yields and fears of a government shutdown hammered stocks last week, with technology shares bearing the brunt of the retreat.

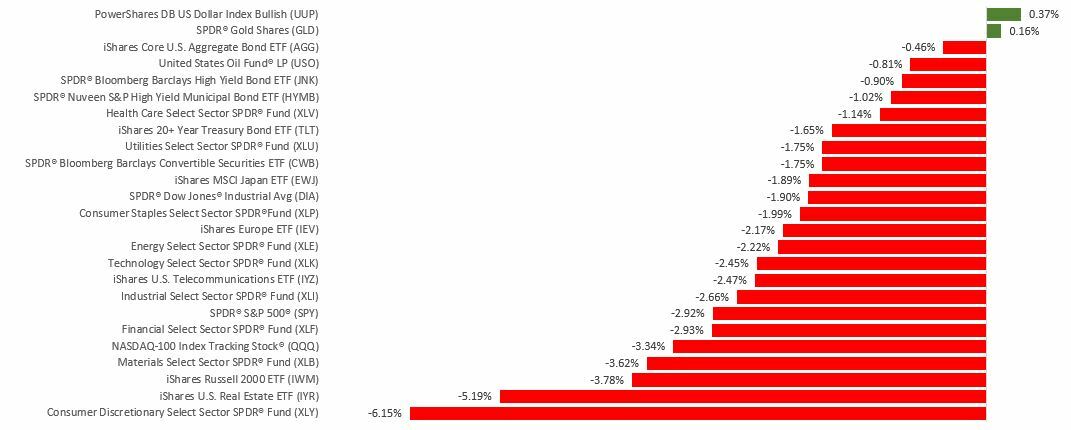

The Dow Jones Industrial Average lost 1.89%, while the Standard & Poor’s 500 dropped 2.93%. The Nasdaq Composite index tumbled 3.62% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, fell 1.77%.

Stocks Sell Off

Investor sentiment took a decidedly negative turn last week when investors were caught off-guard by the Fed signaling another potential rate hike this year, upending hopes that the Fed might finish its current rate-hike cycle.

Stocks declined sharply following the Federal Open Market Committee (FOMC) announcement and continued to fall the following day as bond yields spiked. The 10-year Treasury yield hit 4.48% on Thursday, touching its highest point in more than 15 years.

Stocks also reacted to news that the House of Representatives went into recess on Thursday, increasing the prospect of a government shutdown. The sell-off cooled on Friday, adding only incrementally to the week’s accumulated losses.

Fed Signals Rate Hike

As expected, the Fed held interest rates steady but surprised many investors by signaling another rate hike before year-end and suggesting that rates may need to remain high through 2024. In his post-announcement press conference, Fed Chair Powell remarked the inflation battle would continue, and upcoming economic data would inform the FOMC’s future rate hike decision.

In their economic projections, 12 of 19 Fed officials expect to raise rates once more this year. (The FOMC meets again on October 31-November 1, and in December.) The Fed also lowered their unemployment projection from their June estimate and revised their projection for annual core inflation to 3.7% in the fourth quarter, down from June’s 3.9% forecast.

This Week: Key Economic Data

Tuesday: Consumer Confidence. New Home Sales.

Wednesday: Durable Goods Orders.

Thursday: Jobless Claims. Gross Domestic Product (GDP).

Friday: Personal Income and Outlays.

Source: Econoday, September 22, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Costco Wholesale Corporation (COST)

Wednesday: Micron Technology, Inc. (MU)

Thursday: Nike, Inc. (NKE)

Source: Zacks, September 22, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.