The Weekly Update

Week of July 22, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stock benchmarks retreated during the first week of the second-quarter earnings season. As some big names shared quarterly results, investors seemed more interested in what might happen at the Federal Reserve’s upcoming policy meeting.

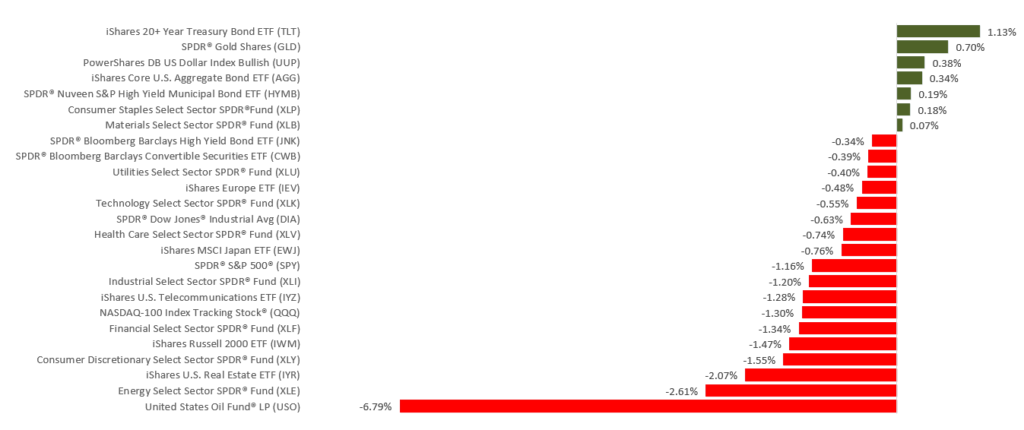

For the week, the S&P 500 declined 1.23%. The Dow Jones Industrial Average lost 0.65%, and the Nasdaq Composite, 1.18%. International stocks, measured by the week-over-week performance of the MSCI EAFE index, were down 0.79%.

Households Bought More Last Month

Retail sales were up 0.4% in June, according to the Department of Commerce. Consumer purchases account for more than two-thirds of America’s gross domestic product, and data like this may rebut some assertions that the economy is losing steam.

Traders still expect the Federal Reserve to make a rate cut at the end of this month, even with low unemployment, solid consumer spending, and stocks near record peaks. Ordinarily, the Fed lowers interest rates to try to stimulate business growth and investment when the economy lags. After ten years without a recession, its new challenge is to make appropriate moves to ward off such a slowdown.

Will Wall Street’s Expectations Be Met?

Thursday, Federal Reserve Bank of New York President John Williams noted that Fed policymakers could proactively adjust interest rates and take “preventative measures” to ward off a potential slowdown. A New York Fed spokesperson later said that Williams’ comments were “academic” and did not concern “potential policy actions.” Still, Fed Vice President Richard Clarida made similar comments last week, expressing the view that Fed officials “don’t have to wait until things get bad to have a dramatic series of rate cuts.”

Two other Fed officials – Esther George and Eric Rosengren – have publicly stated that they are not in favor of a cut.

What’s Next

About 25% of S&P 500 companies report earnings this week. In addition, the federal government will present its first snapshot of the economy’s second-quarter performance.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: June existing home sales figures appear from the National Association of Realtors.

Wednesday: The Census Bureau presents its June report on new home buying.

Friday: The Bureau of Economic Analysis releases its initial estimate of Q2 economic growth.

Source: Econoday / MarketWatch Calendar, July 19, 2019

The Econoday and MarketWatch economic calendars list upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Celanese (CE), Halliburton (HAL), TD Ameritrade (AMTD)

Tuesday: Coca-Cola (KO), Texas Instruments (TXN), Visa (V)

Wednesday: AT&T (T), Boeing (BA), Facebook (FB), PayPal (PYPL)

Thursday: Alphabet (GOOGL), Amazon (AMZN), Anheuser-Busch (BUD), Intel (INTC), Starbucks (SBUX)

Friday: AbbVie (ABBV), Colgate-Palmolive (CL), McDonalds (MCD)

Source: Zacks, July 19, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.