The Weekly Update

Week of June 19th, 2023

By Christopher T. Much, CFP®, AIF®

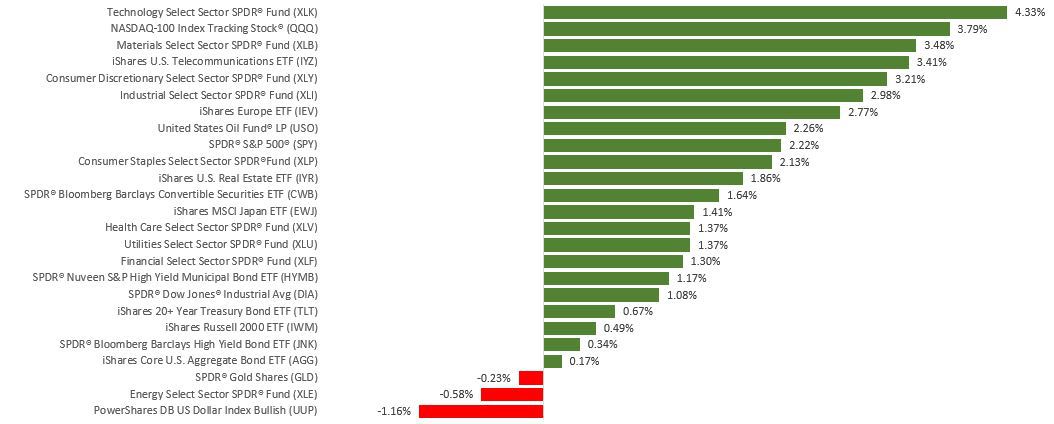

Stocks climbed last week as reassuring inflation data boosted investor hopes that the rate-hike cycle was nearing an end amid fresh economic data pointing to continued economic resilience.

The Dow Jones Industrial Average rose 1.25%, while the Standard & Poor’s 500 picked up 2.58%. The Nasdaq Composite index gained 3.25% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, advanced 2.42%

Stocks Rally

Stock market momentum gathered steam last week, blowing past the 4,300 and 4,400 thresholds in the S&P 500–a remarkable feat considering the time it took to break the 4,200-resistance level.

Optimism was high to begin the week, with expectations that fresh evidence of cooling inflation would provide the Fed room to pause on further rate hikes. The data cooperated as consumer prices rose 4.0% year-over-year (the lowest 12-month number in two years), and producer prices increased 1.1% from a year ago.

The Fed’s “hawkish pause” briefly unsettled investors, but after some reassessment and aid from healthy economic data, stocks rallied before slipping on Friday as the market digested the week’s gains.

More Rate Hikes to Come?

Federal Reserve officials kept rates steady at last week’s Federal Open Market Committee (FOMC) meeting. However, a majority of committee members indicated at least two more quarter-point rate hikes were likely before year-end.

Fed Chair Jerome Powell commented that he saw progress in fighting inflation and that no decision was made regarding any future rate increase, saying that members will assess the economic impact of the cumulative rate hikes before the July 25-26 FOMC meeting.

The Fed raised its 2023 economic growth forecast to 1%, up from its March forecast of 0.4%. The Fed also lowered its unemployment projection to 4.1% from its earlier estimate of 4.5%.

This Week: Key Economic Data

Tuesday: Housing Starts.

Thursday: Existing Home Sales. Index of Leading Economic Indicators. Jobless Claims.

Friday: Purchasing Managers’ Index (PMI) Composite.

Source: Econoday, June 16, 2023

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Tuesday: FedEx Corporation (FDX).

Thursday: Darden Restaurants, Inc. (DRI).

Source: Zacks, June 16, 2023

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.