The Weekly Update

Week of August 17th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

Stock prices drifted higher in an otherwise quiet news week, as a slowdown in new COVID-19 cases outweighed a Congressional impasse on a new fiscal-spending measure.

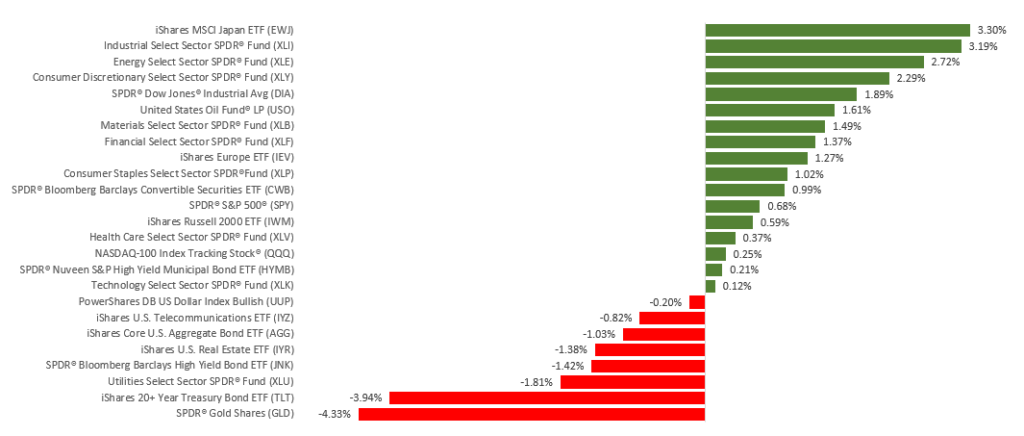

The Dow Jones Industrial Average gained 1.81%, while the Standard & Poor’s 500 rose by 0.64%. The Nasdaq Composite Index inched 0.08% higher for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, advanced 3.11%.

S&P 500 Nears All-Time High

Stock prices were supported by a falling rate of COVID-19 cases nationwide and optimism that – despite a lack of progress on a fiscal-aid bill – Congress would eventually come to a spending agreement.

The industrial and financial sectors saw solid gains, while technology stocks, after slipping earlier in the week, found some footing as the week came to a close.

The S&P 500 Index flirted all week with setting a new record high. At one point on Thursday, it traded above its February 2020 record close before closing slightly lower. Stocks treaded water into Friday, as Congress recessed for the summer.

Consumer Prices Jump

On Wednesday, the Labor Department said that the Consumer Price Index rose 0.6% in July, matching the 0.6% increase in June. The increase was double the consensus estimate of 0.3%. The general view is that the acceleration in consumer prices is more indicative of a healing economy than the beginning of a cycle of higher inflation.

The Fed does not appear concerned about these recent monthly price jumps. It remains more worried about disinflation. However, if inflation continues to pick up, the Fed may be forced to reconsider its COVID-19 monetary policy.

THIS WEEK: KEY ECONOMIC DATA

Tuesday: Housing Starts.

Wednesday: Federal Open Market Committee (FOMC) Minutes.

Thursday: Jobless Claims. Index of Leading Economic Indicators.

Friday: Existing Home Sales.

Source: Econoday, August 14, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: JD.com (JD).

Tuesday: Walmart (WMT), The Home Depot (HD), Kohls (KSS).

Wednesday: Nvidia (NVDA), Target (TGT), Lowe’s (LOW).

Thursday: Alibaba Group (BABA).

Friday: John Deere (DE).

Source: Zacks, August 14, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.