The Weekly Update

Week of October 6th, 2025

By Christopher T. Much, CFP®, AIF®

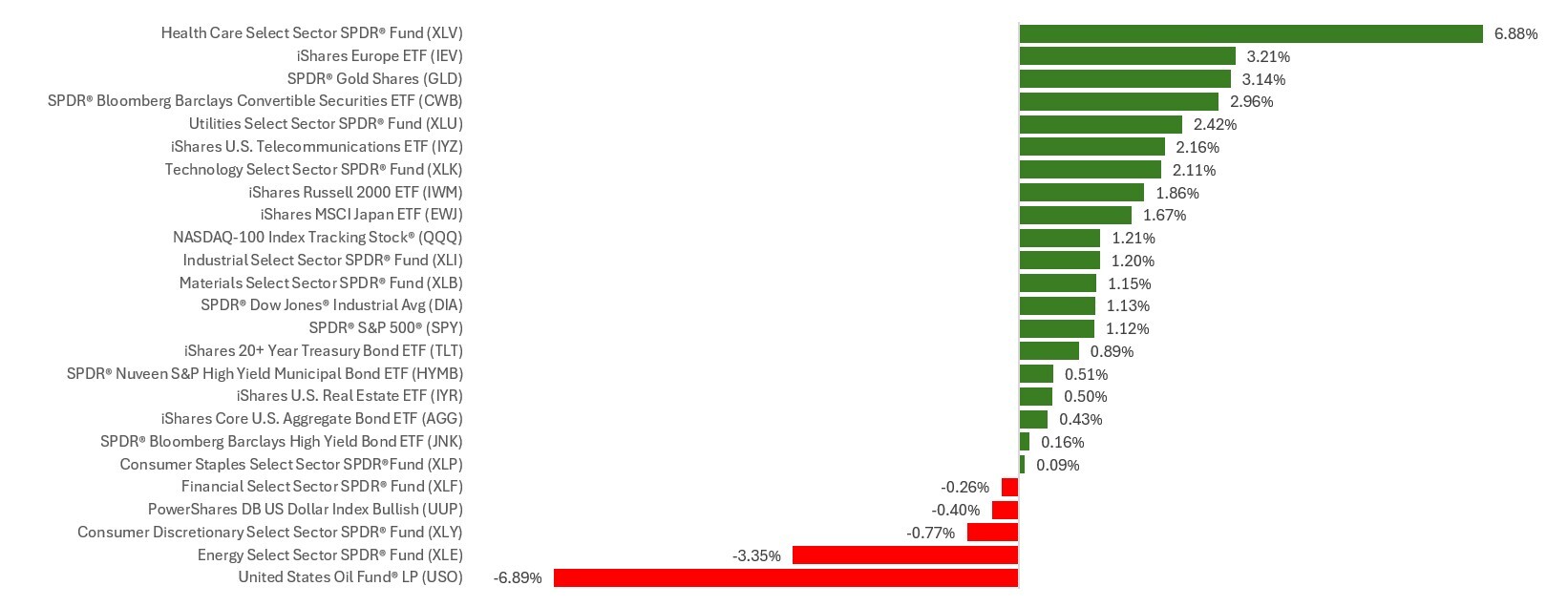

Stocks rose last week, looking past the government shutdown and apparently discounting any impact it may have on the economy.

The Standard & Poor’s 500 Index moved up 1.08 percent, while the Nasdaq Composite Index rose 1.32 percent. The Dow Jones Industrial Average advanced 1.10 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, gained 2.53 percent.

Shutdown Talk

The S&P and Nasdaq rose out of the gate Monday morning despite the threat of a possible government shutdown hanging over investor sentiment.

As the midnight deadline approached for Congress to pass a continuing resolution that would temporarily fund the federal government, the prospect of a shutdown dominated market sentiment. The White House discussed permanent layoffs of some federal workers, stoking fears of further slowing an already sluggish labor market.

Stocks initially fell on news of the shutdown but recovered by midday, driven by growing investor expectations that the shutdown would be short-lived. The S&P closed above 6700 for the first time.

Momentum tempered after Treasury Secretary Scott Bessent suggested gross domestic product (GDP) may take a hit due to the shutdown, but all three averages recovered and closed at record highs.

Stocks were mixed on Friday after the Senate failed to pass dueling funding bills that would have prevented the shutdown from entering its second week.

Jobs Report Delayed

Investors have looked past—but continue to be jittery about—the government shutdown and its potential impact on an otherwise resilient economy, which is experiencing a hiring slowdown.

One of the first impacts felt from the shutdown was the Bureau of Labor Statistics’ monthly employment report, scheduled for release on Friday, but delayed until the government reopens for business. However, ADP’s monthly report, released on Wednesday, showed that corporate employers shed 32,000 jobs in September, below the forecast of 45,000 new jobs.

This Week: Key Economic Data

Tuesday: Trade Deficit—Goods & Services. Consumer Credit. Fed speeches: Raphael Bostic (Atlanta Fed President), Michelle Bowman (Vice Chair for Supervision), Stephen Miran (Fed governor), Neel Kashkari (Minneapolis Fed President).

Wednesday: Fed speeches: Alberto Musalem (St. Louis Fed President), Michael Barr (Fed governor), Neel Kashkari. September FOMC Meeting Minutes. 10-Year Treasury Note Auction.

Thursday: Fed speeches: Chair Jerome Powell, Michelle Bowman, Neel Kashkari, Michael Barr. Weekly Jobless Claims. Wholesale Inventories. Fed Balance Sheet.

Friday: Consumer Sentiment. Federal Budget. Fed President Chicago Austan Goolsbee speech.

Source: Investor’s Business Daily – Econoday economic calendar; October 3, 2025

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Thursday: PepsiCo, Inc. (PEP)

Source: Zacks, October 3, 2025

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.