The Weekly Update

Week of July 25th, 2022

By Christopher T. Much, CFP®, AIF®

Stocks rallied last week as investor spirits lifted thanks to a better-than-expected start to the second-quarter earnings season.

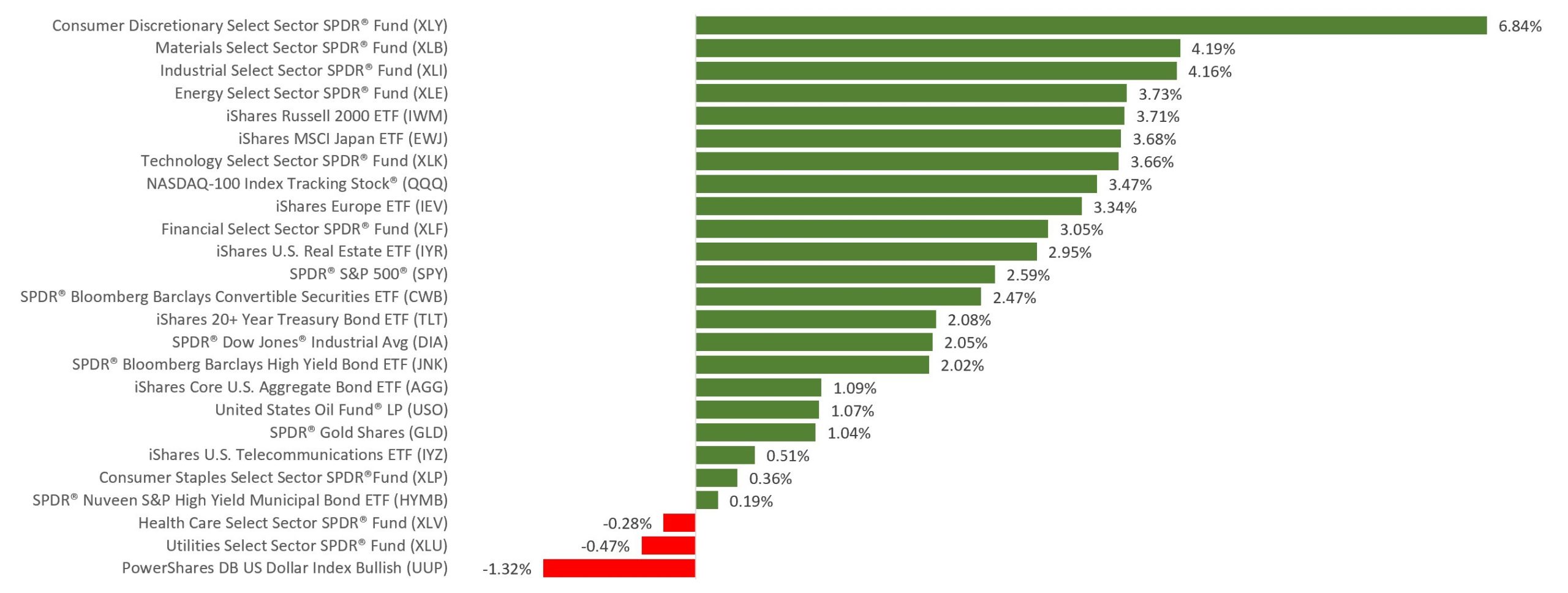

The Dow Jones Industrial Average gained 1.95%, while the Standard & Poor’s 500 added 2.55%. The Nasdaq Composite index jumped 3.33% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, advanced 3.54%.

Earnings Propel Stocks

Earnings season kicked off last week, with major banks reporting second-quarter results. While their results were mixed, they appeared to indicate that consumers and businesses remained reasonably healthy–a perspective that helped erase some negative sentiment overhanging the market.

As the week progressed, stocks gained momentum as earnings results poured in from different sectors of the economy, showing that businesses were navigating higher inflation and slowing growth better than investors feared. Technology and other gloomier sectors were among the market’s best performers for the week. A few disappointing corporate reports and a weak economic report sent stocks lower to close out a solid week.

Cracks in the Foundation

Data released last week indicated more trouble in the housing market. The latest monthly homebuilder sentiment survey showed the single largest monthly drop in its 37-year history, except for April 2020. The sentiment report preceded a drop in June housing starts and issued building permits. Housing starts declined for the second month, falling 2.0% and surprising economists who had expected an increase.

Housing weakness made itself known through a 5.4% month-over-month decline in June’s existing home sales, representing the slowest pace since June 2020. Increasing prices and higher mortgage rates demonstrated drags on buyer demand.

This Week: Key Economic Data

Tuesday: New Home Sales.

Wednesday: FOMC Announcement. Durable Goods Orders.

Thursday: Gross Domestic Product (GDP). Jobless Claims.

Source: Econoday, July 22, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Microsoft Corporation (MSFT), General Electric Company (GE), Visa, Inc. (V), Alphabet, Inc. (GOOGL), General Motors Company (GM), The Coca Cola Company (KO), McDonald’s Corporation (MCD), Archer Daniels Midland Company (ADM), 3M Company (MMM), Texas Instruments, Inc. (TXN), United Parcel Service, Inc. (UPS), KimberlyClark Corporation (KMB).

Wednesday: The Boeing Company (BA), Ford Motor Company (F), Qualcomm, Inc. (QCOM), Bristol Myers Squibb Company (BMY), Lam Research Corporation (LRCX), Shopify, Inc. (SHOP), ServiceNow, Inc. (NOW), General Dynamics Corporation (GD), Norfolk Southern Corporation (NSC).

Thursday: Apple, Inc. (AAPL), Intel Corporation (INTC), Mastercard, Inc. (MA), Pfizer, Inc. (PFE), Merck & Co., Inc. (MRK), The Southern Company (SO), Northrop Grumman Corporation (NOC), Southwest Airlines (LUV).

Friday: AbbVie, Inc. (ABBV), Exxon Mobil Corporation (XOM), Chevron Corporation (CVX), The Procter & Gamble Company (PG), ColgatePalmolive Company (CL).

Source: Zacks, July 22, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.