The Weekly Update

Week of February 12th, 2024

By Christopher T. Much, CFP®, AIF®

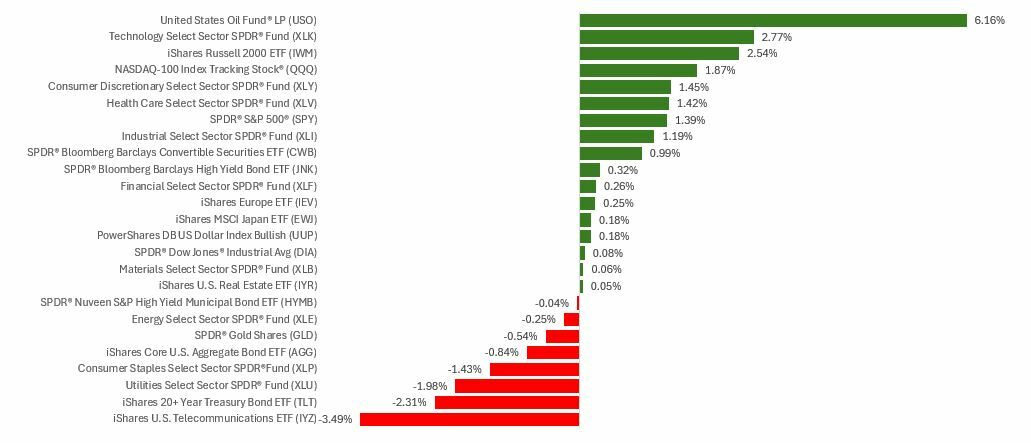

The stock market experienced solid gains last week, concluding the trading week on a positive note, thanks to robust corporate reports and favorable inflation news; this propelled the S&P 500 Index to achieve a new record high at the end of the week.

S&P Tops 5,000

At the start of last week’s trading, stocks faced downward pressure due to comments by Fed Chair Powell over the weekend, signaling that the Federal Reserve had no immediate plans to initiate interest rate cuts. Consequently, the yield on the two-year U.S. Treasury notes, highly influenced by monetary policy, increased to its highest level in two months.

By the end of trading on Monday, stocks had regained a significant portion of their previous losses. Influencing this market rally were positive corporate earnings reports. This trend continued throughout the week, contributing to the overall market momentum. By Friday, 67% of the companies listed in the S&P 500 had released their Q4 results, and an impressive 77% of those companies exceeded earnings expectations.

Investors expressed enthusiasm on Friday after a report indicating that December’s inflation was lower than initially anticipated. This positive news revitalized buying activity, resulting in the S&P 500 surpassing 5,000 for the first time.

Economic Strength

The strength of the U.S. economy has come into the spotlight. An analysis conducted by The Wall Street Journal recently proposed that the economy’s resilience could be attributed, at least in part, to the productivity driven by the technology sector.

What might rein in that productivity? One possible influence could be the increase in oil prices witnessed last week. Additionally, shipping companies have been imposing surcharges for several months to mitigate recent conflict, and these charges may contribute to global inflation this year, potentially dampening investor enthusiasm.

This Week: Key Economic Data

Tuesday: Consumer Price Index (CPI).

Wednesday: EIA Petroleum Report.

Thursday: Industrial Production. Retail Sales. Jobless Claims.

Friday: Housing Starts. Producer Price Index (PPI). Consumer Sentiment.

Source: Econoday, February 8, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This Week: Companies Reporting Earnings

Monday: Arista Networks, Inc. (ANET), Waste Management, Inc. (WM)

Tuesday: The CocaCola Company (KO), Shopify Inc. (SHOP), AirBnB, Inc. (ABNB), Moody’s Corporation (MCO)

Wednesday: Cisco Systems, Inc. (CSCO), Sony Corporation (SONY), Kraft Heinz Company (KHC)

Thursday: Applied Materials, Inc. (AMAT), Deere & Company (DE)

Source: Zacks, February 8, 2024

The companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.