The Weekly Update

Week of April 29, 2019

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

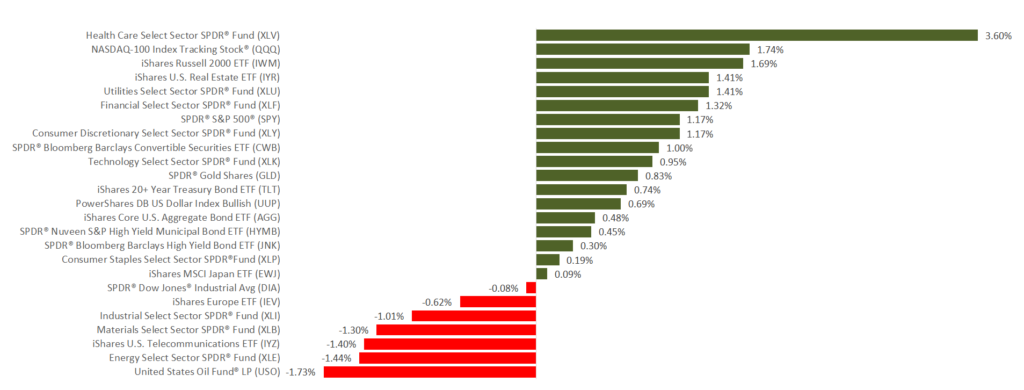

Stocks returned to record territory, with both the S&P 500 and the Nasdaq Composite closing at historic highs. The S&P gained 1.20% for the week; the Nasdaq, 1.85%. The Dow Jones Industrial Average lagged, losing 0.06%. The MSCI EAFE index of international stocks lost 0.52%.

The S&P took only 17 weeks to fully rebound from its December low.

A Shift in Focus

Last month, Wall Street fixated on trade, reacting to even the slightest hint of progress in U.S.-China negotiations. This month, the trade talks have taken a back seat, and the fixation is on earnings.

Anxieties about a possible earnings recession may be fading. So far, first-quarter results for S&P 500 firms are 5.3% above expectations; that compares to a 5-year average of 4.8%.

At some point, trade talk will come back, or other developments will lead Wall Street to chase other trends. The thing to remember is that Wall Street is fickle: what preoccupies it one week may be shrugged off the next. Short-term trends ultimately amount to background noise during the long-term pursuit of your financial goals.

A Strong First Quarter

Friday, the Bureau of Economic Analysis said that the economy expanded at a 3.2% pace in Q1. The number surprised to the upside. Economists surveyed by Dow Jones estimated Q1 gross domestic product would increase 2.5%.

What’s Ahead

Investors have all kinds of news to consider this week. There will be a plethora of earnings calls, plus important reports on consumer spending and hiring. Also, Federal Reserve chair Jerome Powell will hold a press conference following the central bank’s May meeting.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: March personal spending figures from the Department of Commerce.

Tuesday: The Conference Board’s April consumer confidence index.

Wednesday: The Federal Reserve announces its latest interest rate decision.

Friday: The April jobs report from the Department of Labor.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Alphabet (GOOGL), Kemper (KMPR)

Tuesday: Amgen (AMGN), Apple (AAPL), Cummins (CMI), McDonalds (MCD)

Wednesday: Allstate (ALL), CVS Health (CVS), Humana (HUM), Public Storage (PSA)

Thursday: CBS (CBS), Cigna (CI), Dunkin’ Brands (DNKN), Gilead Sciences (GILD)

Friday: Fiat Chrysler (FCAU)