The Weekly Update

Week of June 10th, 2024

By Christopher T. Much, CFP®, AIF®

Stocks rose last week despite conflicting stories from economic reports.

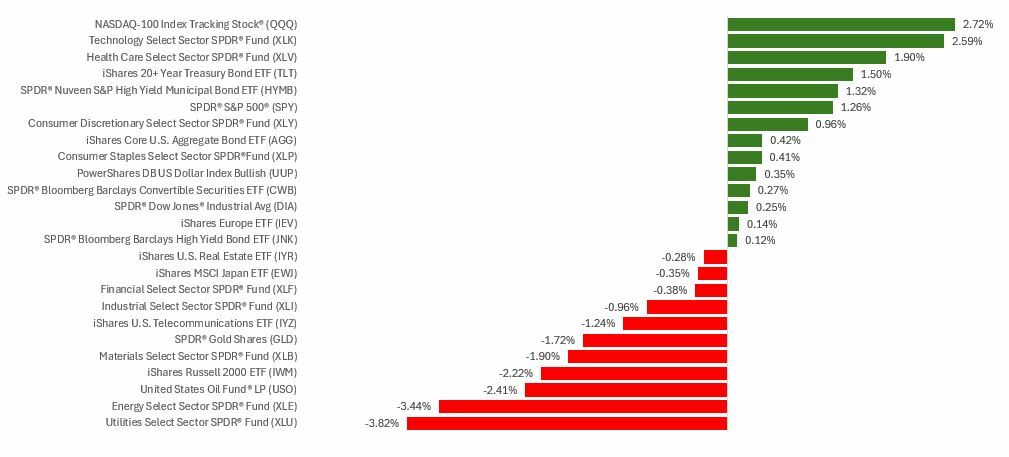

The Dow Jones Industrial Average inched up 0.29 percent while the Standard & Poor’s 500 Index powered ahead 1.31 percent. The Nasdaq Composite led, picking up 2.38 percent. The MSCI EAFE Index tracks developed overseas stock markets and rose 1.29 percent for the week through Thursday’s close.

All Eyes on The Jobs Report

Weak manufacturing data prompted declines early in the week, reflecting investor concerns over the economy’s strength. But stocks rallied in anticipation of the jobs report on Friday.

However, the market reaction was mixed when the stronger-than-expected jobs report finally came. The S&P 500 touched a record high intraday before profit-taking late in the session.

The Catalyst That Wasn’t

The week closed with a jobs report that underscored the economy’s resilience while highlighting the data’s mixed nature.

The 272,000 jobs added in May were higher than the 190,000 economists expected. At the same time, wages rose 4.1 percent from a year ago. The strong jobs report and surprise wage increase supported the narrative that the Fed may now wait longer before considering a move on interest rates.

Although inflation now exceeds the central bank’s 2 percent target, the jobs report suggests that economic growth remains powerful despite higher short-term rates.

This Week: Key Economic Data

Monday: 3-Month Treasury Bill Auction.

Wednesday: Consumer Price Index. FOMC Announcement. Fed Chair Press Conference.

Thursday: Jobless Claims. Producer Price Index (final). Fed Official John Williams speaks.

Friday: Consumer Sentiment. Fed Official Austan Goolsbee speaks.

Source: Investor’s Business Daily – Econoday economic calendar; June 7, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: Broadcom Inc. (AVGO)

Thursday: Adobe Inc. (ADBE), Autodesk, Inc. (ADSK)

Source: Zacks, June 7, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.