The Weekly Update

Week of July 18th, 2022

By Christopher T. Much, CFP®, AIF®

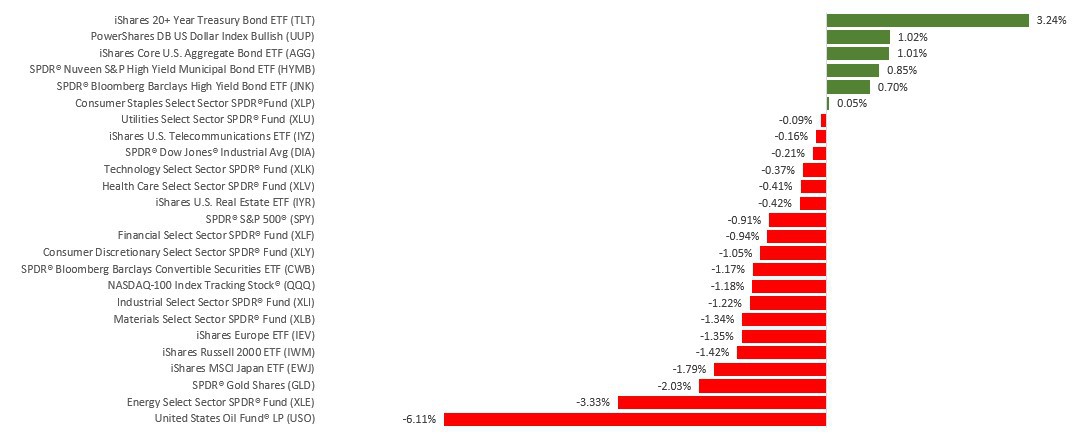

A record-high inflation report, the prospects of a more aggressive Fed, and growing recession fears sent stocks lower – though losses were pared by a Friday rally.

The Dow Jones Industrial Average slipped 0.16%, while the Standard & Poor’s 500 lost 0.93%. The Nasdaq Composite index dropped 1.57% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, lost 3.49%.

Stocks Slide

As the week opened, recession fears intensified with reports of renewed Covid-related lockdowns in China. Also, the U.S. dollar continued to climb, reflecting global economic weakness.

June’s consumer price index report showed price increases accelerating. Year-over-Year prices jumped 9.1%, the fastest pace in over 40 years. Speculation grew that the Federal Reserve might contemplate a 100-basis point increase in short-term rates later this month, rather than the 75-basis point hike it earlier signaled. The market rebounded on Friday following comments by a Federal Open Market Committee member who said he favored a 75-basis point hike. Also helping the Friday rally was a strong retail sales report and additional second-quarter company reports.

Dollar Strength

The increasing strength of the U.S. dollar moved to center stage last week as the dollar index (a measure of the U.S. dollar to six other major currencies) reached a fresh high, while the euro fell to parity with the dollar and to its lowest level since 2002.

A rising U.S dollar hurts overseas profits when converted into dollars and it also makes U.S. products and services more expensive. It’s a challenge for large, multinational companies that derive a portion of their earnings from overseas markets. Greater insight into the extent of that impact may be gained as companies provide forward guidance with their upcoming reports.

This Week: Key Economic Data

Tuesday: Housing Starts.

Wednesday: Existing Home Sales.

Thursday: Jobless Claims. Index of Leading Economic Indicators.

Friday: Purchasing Managers’ Index (PMI) Composite Flash.

Source: Econoday, July 15, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Bank of America (BAC), International Business Machines (IBM), The Goldman Sachs Group (GS), The Charles Schwab Corporation (SCHW)

Tuesday: Netflix, Inc. (NFLX), Johnson & Johnson (JNJ), J.B. Hunt Transport Services, Inc. (JBHT)

Wednesday: Tesla, Inc. (TSLA), Abbott Laboratories (ABT), CSX Corporation (CSX), United Airlines Holdings, Inc. (UAL)

Thursday: AT&T, Inc. (T), Snap, Inc. (SNAP), Blackstone, Inc. (BX), American Airlines Group, Inc. (AAL), Union Pacific Corporation (UNP), D.R. Horton, Inc. (DHI)

Friday: Verizon Communications, Inc. (VZ), Schlumberger Limited (SLB), American Express Company (AXP), NextEra Energy, Inc. (NEE), PPG Industries, Inc. (PPG)

Source: Zacks, July 15, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.