The Weekly Update

Week of June 29th, 2020

By Christopher T. Much, CFP®, AIF®

The Week on Wall Street

A jump in COVID-19 cases dampened investor enthusiasm last week, sending stock prices lower on worries that rising infections could derail the economic recovery.

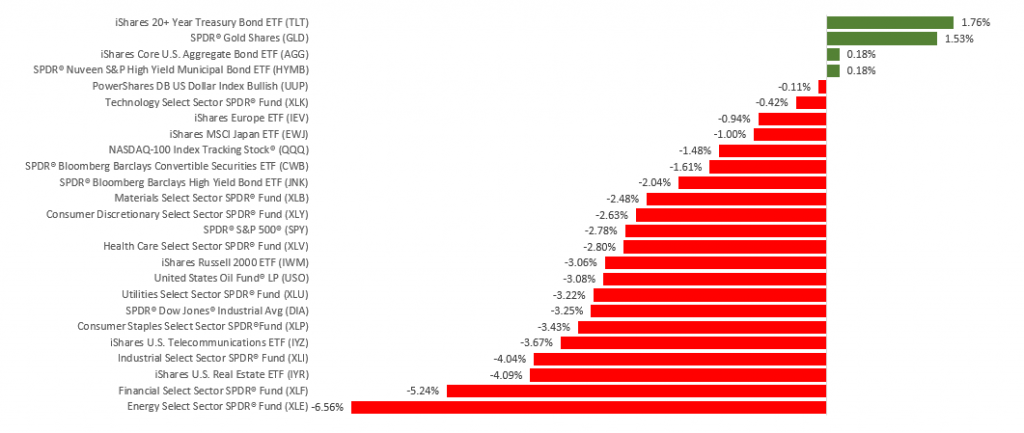

The Dow Jones Industrial Average slumped 3.31%, while the Standard & Poor’s 500 retreated 2.86%. The Nasdaq Composite Index lost 1.90% for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, declined 1.28%.

A Rocky Week for Stocks

Investors began the week overlooking a jump in COVID-19 cases in some early reopening states, sending stocks higher and powering the NASDAQ Composite to close above 10,000 and establish a new record high on successive days. But the market quickly reversed course as investors reacted to data showing a troubling spike in nationwide COVID-19 cases.

In Thursday’s trading, stocks opened lower but then rallied late in the day on no apparent news. Stocks resumed their decline on Friday, falling on news that Texas and Florida were rolling back some reopening plans amid rising COVID-19 infections.

COVID-19 Cases

Investor expectations for an economic rebound took a hit last week, following reports of an increase in nationwide COVID-19 cases. The pace of infections had picked up in 33 states, with the seven-day average of new cases higher than the average over the last two weeks.

While traders understood that reopening and increased testing would lead to an uptick in reported cases, the numbers were a bit unsettling. The week’s action reminded investors that the market remains tightly tethered to COVID-19 developments.

THIS WEEK: KEY ECONOMIC DATA

Wednesday: ADP (Automatic Data Processing) Employment Report. Purchasing Managers Index (PMI) Manufacturing Index. Institute for Supply Management (ISM) Manufacturing Index. Federal Open Market Committee (FOMC) Minutes.

Thursday: Employment Situation Report. Jobless Claims. Factory Orders.

Source: Econoday, June 26, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Micron Technologies (MU).

Tuesday: FedEx Corp. (FDX), Conagra Brands (CAG).

Wednesday: Constellation Brands (STZ), General Mills (GIS).

Source: Zacks, June 26, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.